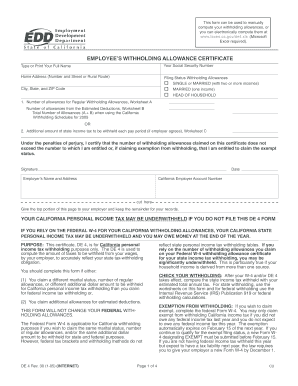

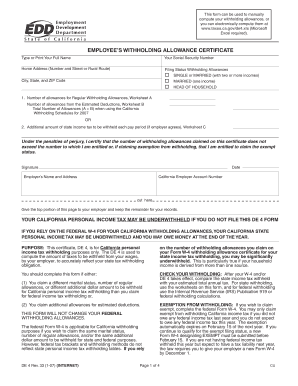

California State Withholding Form

What is california state withholding form?

The California State Withholding Form is a document that employers use to calculate and withhold the correct amount of state income tax from their employees' wages. It ensures that employees pay the appropriate amount of state taxes throughout the year.

What are the types of california state withholding form?

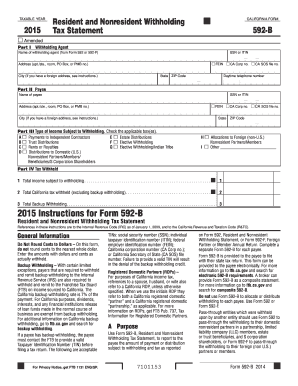

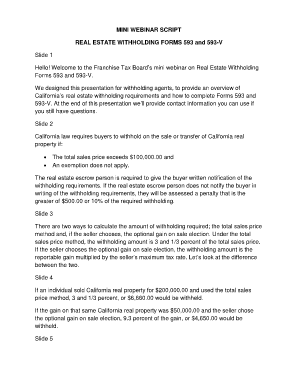

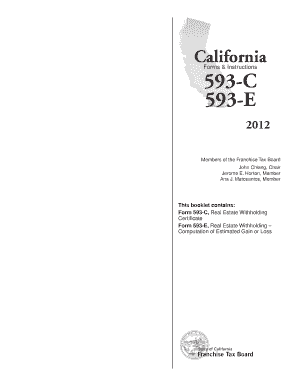

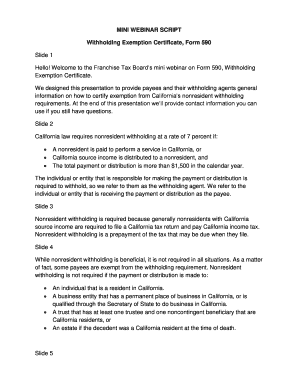

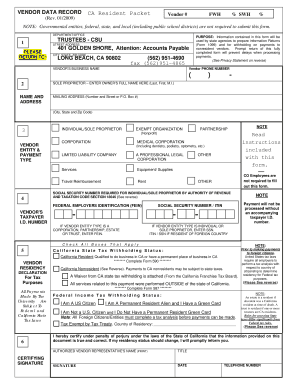

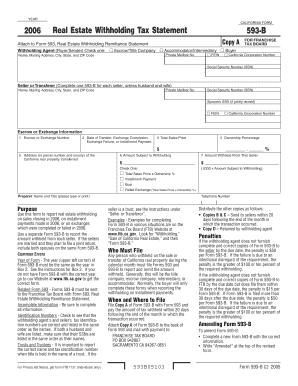

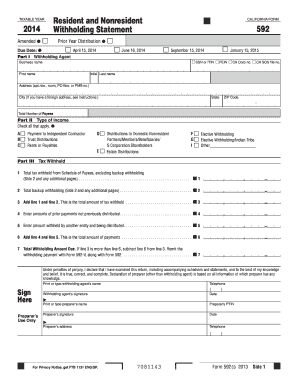

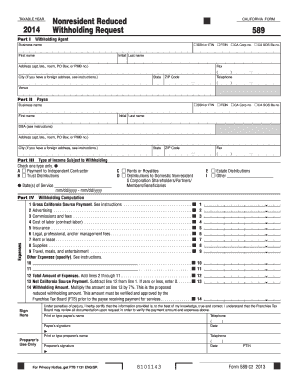

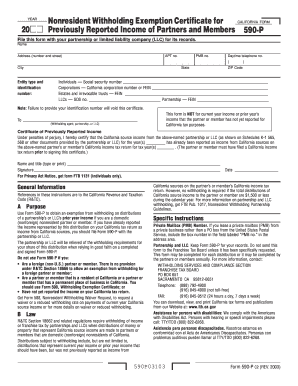

There are several types of California State Withholding Forms, each designed for different purposes. The most common forms include: - Form DE 4: Employee's Withholding Allowance Certificate - Form 590: Withholding Exemption Certificate for Military Spouse - Form 587: Nonresident Withholding Allocation Worksheet - Form 592: Resident and Nonresident Withholding Statement - Form 593: Real Estate Withholding Tax Statement These forms cater to specific circumstances and requirements, ensuring accurate withholding of state income tax.

How to complete california state withholding form

Completing the California State Withholding Form is a straightforward process. The following steps will guide you through the completion: 1. Obtain the correct form: Identify the specific form that corresponds to your situation and download it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.