What is car payment calculator with trade in?

A car payment calculator with trade in is a useful tool that helps you determine the monthly payments for a car loan, taking into account the value of your current vehicle as a trade-in. It considers the trade-in value when calculating the loan amount, interest rate, and loan term, providing you with a more accurate estimate of your monthly payments. This calculator helps you make informed decisions about your car purchase and understand the impact of trading in your current vehicle.

What are the types of car payment calculator with trade in?

There are several types of car payment calculators with trade in that you can use:

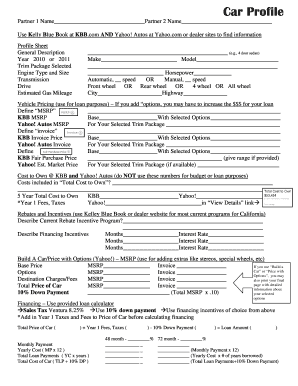

Standard Car Payment Calculator: This type of calculator allows you to enter the trade-in value of your current vehicle and provides you with the estimated monthly payments based on the loan amount, interest rate, and loan term.

Advanced Car Payment Calculator: This calculator not only considers the trade-in value but also allows you to factor in additional costs such as taxes, fees, and down payment. It provides a more comprehensive estimate of your monthly payments.

Lease Calculator with Trade-In: If you're considering leasing a vehicle and trading in your current car, this calculator helps you estimate the monthly lease payments taking into account the trade-in value.

Auto Loan Refinance Calculator with Trade-In: This calculator is specifically designed for those looking to refinance their car loan while trading in their current vehicle. It helps you determine the new monthly payments and potential savings by refinancing.

Comparison Calculator: This type of calculator allows you to compare the monthly payments with and without a trade-in. It helps you evaluate the financial impact of trading in your car.

How to complete car payment calculator with trade in

Completing a car payment calculator with trade in is a simple process. Here are the steps to follow:

01

Enter the trade-in value of your current vehicle. This can be determined by researching the market value or consulting with a car dealership.

02

Input the loan amount, interest rate, and loan term for the new car loan you plan to take.

03

If applicable, provide additional details such as taxes, fees, and down payment.

04

Click on the 'Calculate' button to get the estimated monthly payments based on the trade-in value.

Using a car payment calculator with trade in empowers you to make informed decisions about your car purchase. It helps you understand the impact of trading in your current vehicle and provides you with accurate estimates of your monthly payments. pdfFiller is the ultimate solution for creating, editing, and sharing documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.