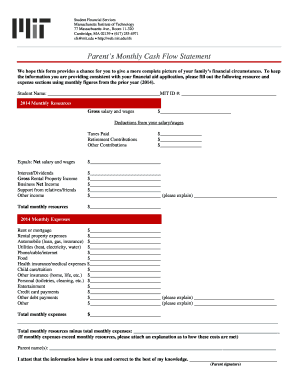

Cash Flow Statement Template

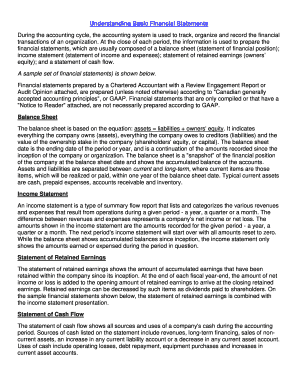

What is Cash Flow Statement Template?

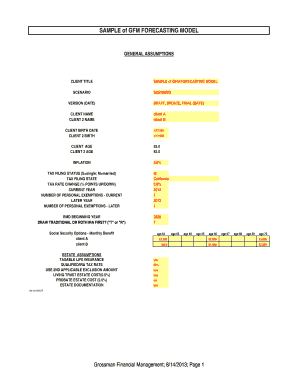

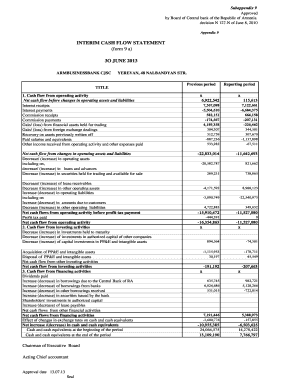

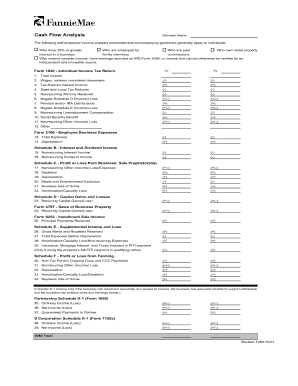

A Cash Flow Statement Template is a tool used by businesses to track their cash inflows and outflows over a specific period of time. It provides a summary of the cash generated and spent by the business, helping to assess its financial health and make informed decisions. With a Cash Flow Statement Template, businesses can monitor their sources of cash, such as sales revenue and loans, as well as their uses of cash, such as operating expenses and debt payments.

What are the types of Cash Flow Statement Template?

There are two main types of Cash Flow Statement Template: the direct method and the indirect method. 1. Direct Method: This type of template provides a detailed breakdown of cash inflows and outflows, showing the exact sources and uses of cash. 2. Indirect Method: This type of template starts with net income and adjusts it for non-cash expenses and changes in working capital to arrive at the net cash provided by operating activities. It is commonly used due to its simplicity and compatibility with accounting systems.

How to complete Cash Flow Statement Template

Completing a Cash Flow Statement Template requires the following steps: 1. Gather financial data: Collect the necessary financial information, such as income statements, balance sheets, and cash flow records. 2. Identify cash inflows: Determine the sources of cash, such as sales revenue, loans, and investments. 3. Determine cash outflows: Identify the uses of cash, including operating expenses, debt payments, and investments. 4. Calculate net cash flow: Calculate the difference between cash inflows and outflows to determine the net cash flow. 5. Analyze the cash flow: Assess the financial health of the business by comparing the net cash flow to previous periods and industry benchmarks. By following these steps, businesses can accurately complete their Cash Flow Statement Template and gain valuable insights into their cash flow.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.