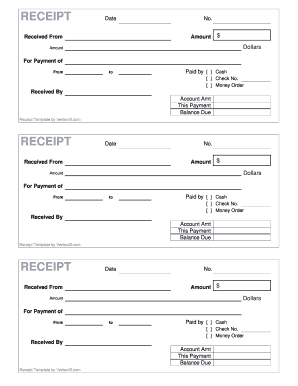

Cash Receipt Templates

What are Cash Receipt Templates?

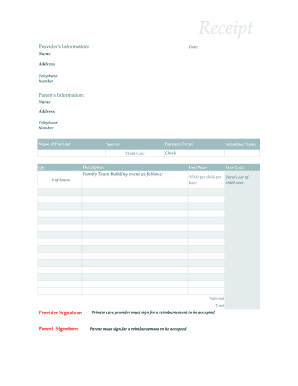

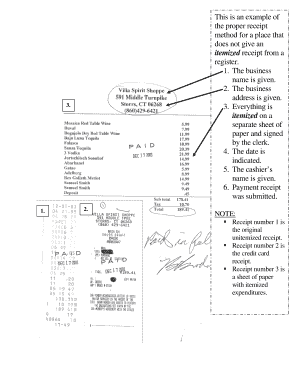

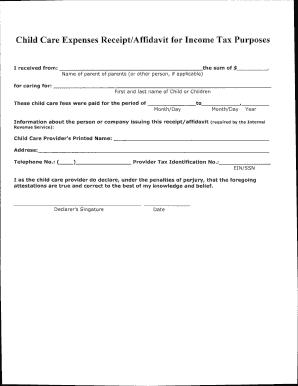

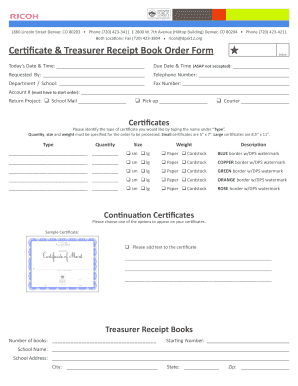

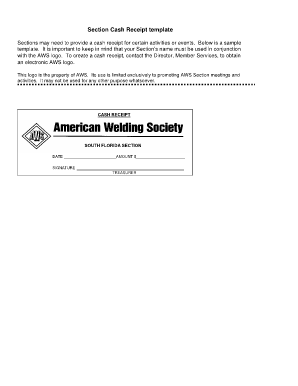

Cash receipt templates are pre-designed documents that enable individuals or businesses to generate receipts for the cash transactions they conduct. These templates provide a structured format for recording important details such as the amount of cash received, the purpose of the transaction, and the date of receipt. By using cash receipt templates, users can easily create professional and accurate receipts for their financial records.

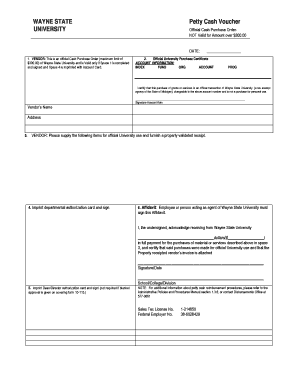

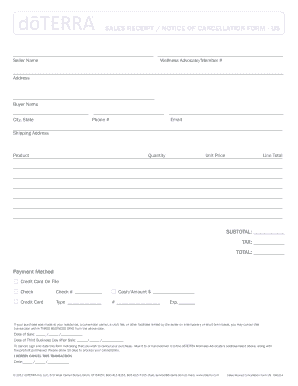

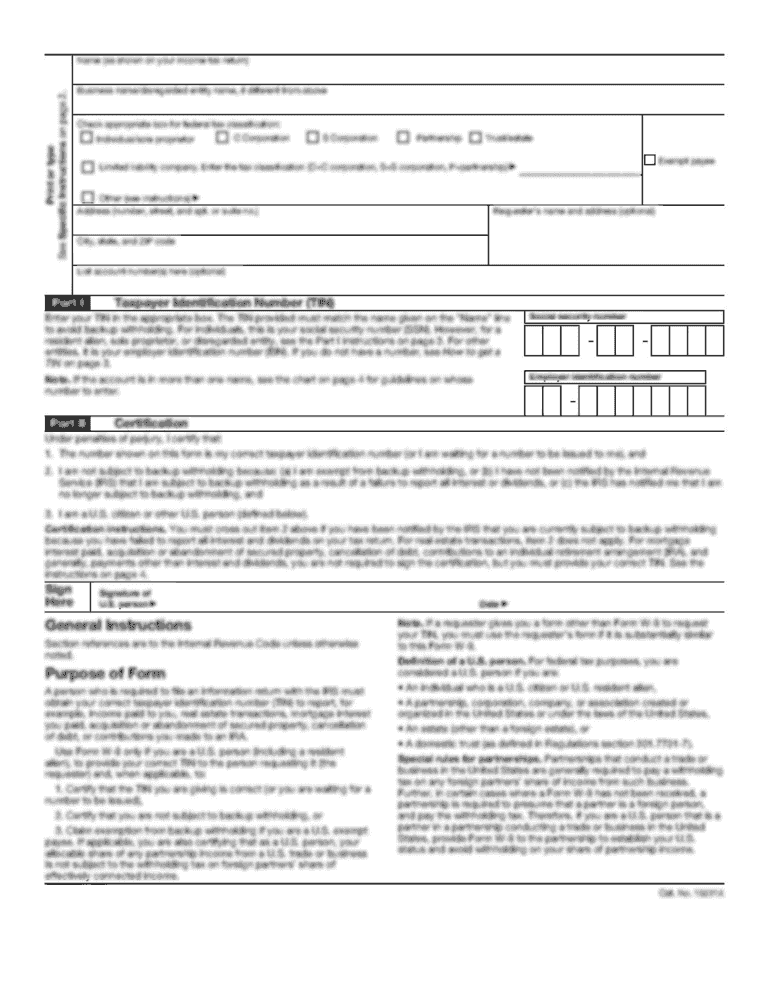

What are the types of Cash Receipt Templates?

There are various types of cash receipt templates available to cater to different needs. Some popular types include:

How to complete Cash Receipt Templates

Completing cash receipt templates is a simple process that involves the following steps:

By following these steps, users can accurately complete cash receipt templates and maintain organized records of their cash transactions. With the help of customizable templates offered by pdfFiller, you can easily create, edit, and share your cash receipts online, saving time and ensuring professionalism.