Chapter 7 Bankruptcy Forms

What is chapter 7 bankruptcy forms?

Chapter 7 bankruptcy forms are legal documents that individuals or businesses need to fill out when filing for Chapter 7 bankruptcy. These forms provide detailed information about the debtor's financial situation, assets, liabilities, and income. By completing these forms accurately and honestly, debtors can seek debt relief and have their unsecured debts discharged.

What are the types of chapter 7 bankruptcy forms?

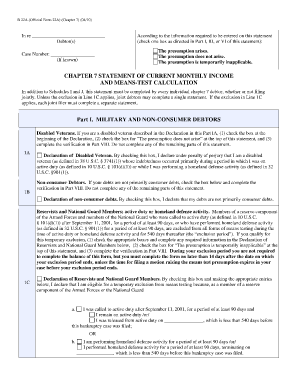

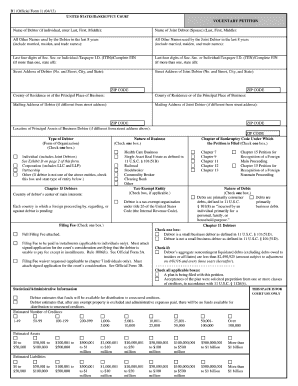

There are several types of chapter 7 bankruptcy forms that need to be completed. These include: 1. Petition, Schedules, and Statement of Financial Affairs 2. Statement of Intentions 3. Statement of Current Monthly Income and Means Test Calculation 4. Schedules of Assets and Liabilities 5. Statement of Exempt Property 6. Declaration About an Individual Debtor's Schedules 7. Statement of Financial Affairs for Non-Individuals 8. Chapter 7 Statement of Your Current Monthly Income By correctly filling out these forms, debtors provide a comprehensive overview of their financial situation to the bankruptcy court.

How to complete chapter 7 bankruptcy forms

Completing chapter 7 bankruptcy forms can be a complex process, but with the right guidance, it can be manageable. Here are some steps to help you: 1. Gather all necessary financial information, including income, assets, and liabilities. 2. Start with the Petition, Schedules, and Statement of Financial Affairs form. Provide accurate and detailed information about your financial situation. 3. Determine your exemptions and complete the Statement of Exempt Property form. 4. Complete the Statement of Intentions form to outline how you plan to handle secured debts. 5. Fill out the other required forms, such as the Statement of Current Monthly Income and Means Test Calculation and Schedules of Assets and Liabilities. 6. Review all the completed forms for accuracy and completeness before submitting them to the bankruptcy court. By following these steps and seeking professional advice if needed, you can successfully complete chapter 7 bankruptcy forms and proceed with your debt relief process.

pdfFiller empowers users to create, edit, and share documents online, including chapter 7 bankruptcy forms. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to efficiently complete their bankruptcy forms and streamline their document management process.