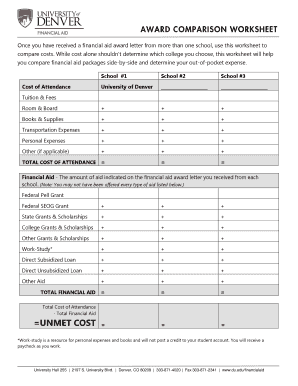

College Cost Comparison Worksheet

What is college cost comparison worksheet?

A college cost comparison worksheet is a helpful tool that allows students and their families to compare the costs associated with different colleges and universities. It helps them make informed decisions about which institution is the best fit for their financial situation.

What are the types of college cost comparison worksheet?

There are several types of college cost comparison worksheets available. Here are some common ones: 1. Tuition and fees comparison worksheet 2. Room and board comparison worksheet 3. Financial aid comparison worksheet 4. Scholarship comparison worksheet These worksheets help students compare the costs of specific components of attending college and enable them to analyze their financial options effectively.

How to complete college cost comparison worksheet

Completing a college cost comparison worksheet is easy with the right steps. Here's how: 1. Gather the necessary information, including tuition fees, room and board costs, financial aid offers, and scholarship details. 2. List the colleges or universities you are considering in the worksheet. 3. Enter the costs associated with each institution, such as tuition fees, room and board expenses, and additional fees. 4. Compare the total costs of each college and evaluate the financial aid options available. 5. Consider the scholarships and grants offered by each institution. 6. Analyze the data and make an informed decision based on your financial situation and preferences.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.