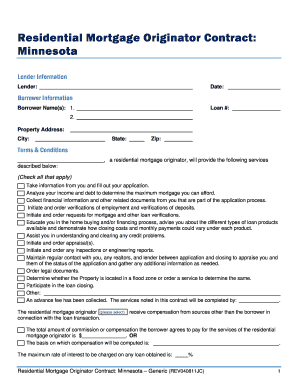

What is a contract for mortgage?

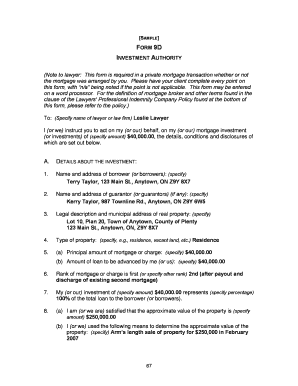

A contract for mortgage, also known as a mortgage contract or mortgage agreement, is a legal document that outlines the terms and conditions of a loan used to purchase a property. This contract serves as a binding agreement between the borrower and the lender, establishing the obligations and rights of both parties. It includes details such as the loan amount, interest rate, repayment schedule, and any additional clauses specific to the mortgage agreement.

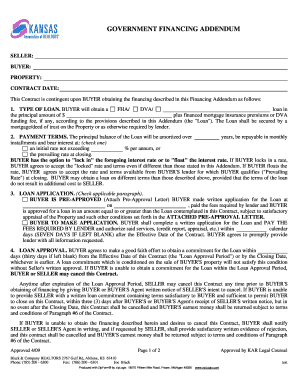

What are the types of contract for mortgage?

There are several types of contracts for mortgage available, depending on the specific needs and circumstances of the borrower. Some common types include:

Fixed-Rate Mortgage: This type of mortgage offers a fixed interest rate for the entire loan term, providing stability and predictability in monthly payments.

Adjustable-Rate Mortgage (ARM): With an ARM, the interest rate fluctuates over time, typically based on market conditions. This type of mortgage offers initial lower interest rates that may increase or decrease depending on the market.

FHA Loan: This type of mortgage is insured by the Federal Housing Administration and is often preferred by first-time homebuyers or those with lower credit scores.

VA Loan: Available to eligible veterans and military service members, this type of mortgage is guaranteed by the Department of Veterans Affairs and offers favorable terms and benefits.

Jumbo Loan: Jumbo mortgages are used for higher-priced properties that exceed the conforming loan limits set by Fannie Mae and Freddie Mac.

Interest-Only Mortgage: With an interest-only mortgage, the borrower only pays interest for a certain period, typically the first few years, before starting to pay principal as well.

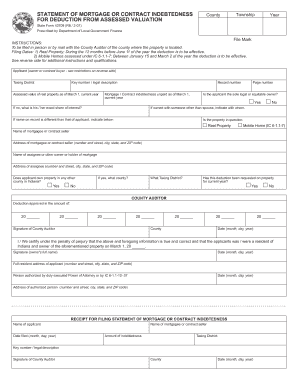

How to complete a contract for mortgage?

Completing a contract for mortgage involves several important steps. Here is a guide to help you:

01

Gather the necessary documents, including identification, proof of income, and details about the property.

02

Review the terms and conditions of the mortgage contract carefully, ensuring that you understand all the clauses and obligations.

03

Fill in the required information accurately, including the loan amount, interest rate, repayment schedule, and any additional provisions.

04

Double-check all the details to ensure accuracy and completeness.

05

Sign the contract and have it notarized, if required.

06

Submit the completed contract to the lender for approval and processing.

pdfFiller empowers users to create, edit, and share documents online, including contracts for mortgage. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that users need to efficiently complete their mortgage-related documents.