Cost Benefits Analysis Example

What is Cost Benefits Analysis Example?

Cost Benefits Analysis Example is a method used to assess the feasibility of a project or decision by comparing the costs involved with the potential benefits. It helps organizations evaluate whether a particular action or investment is worth pursuing based on its monetary value. By analyzing the costs and benefits, businesses can make informed decisions that optimize their resources and maximize their returns.

What are the types of Cost Benefits Analysis Example?

There are various types of Cost Benefits Analysis Example that can be applied depending on the nature and scope of the project. Some common types include:

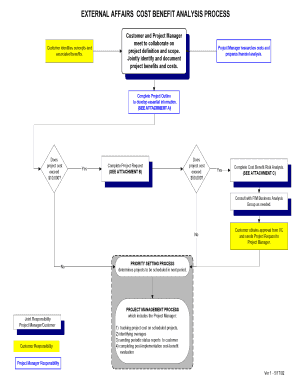

How to complete Cost Benefits Analysis Example

Completing a Cost Benefits Analysis Example involves several steps that should be followed to ensure accurate and reliable results. Here is a step-by-step guide to completing a Cost Benefits Analysis Example:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.