Credit Application Form Pdf

What is credit application form pdf?

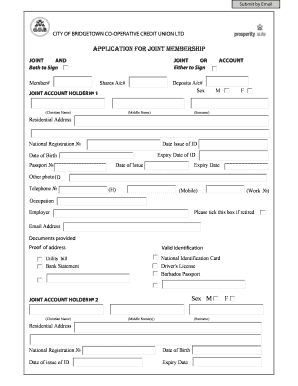

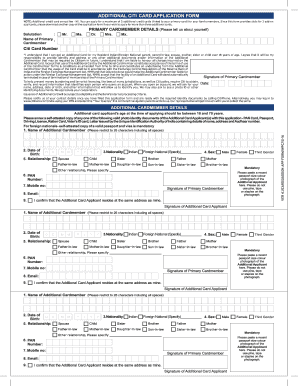

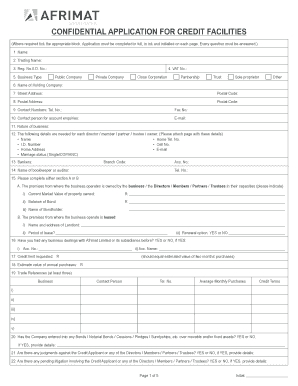

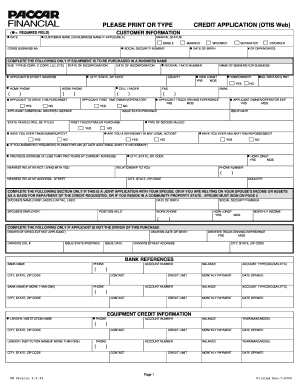

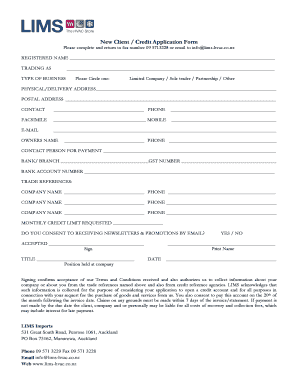

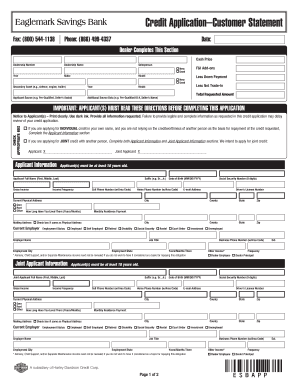

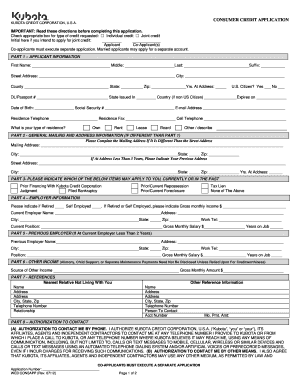

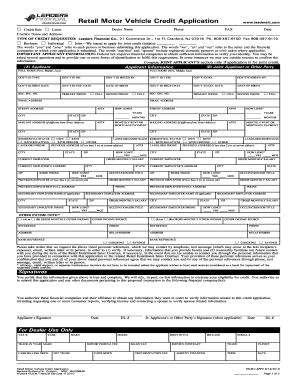

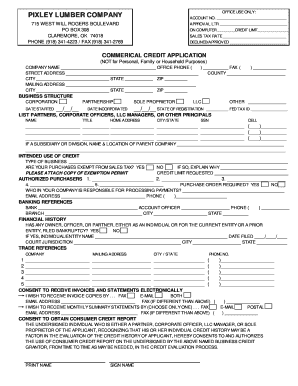

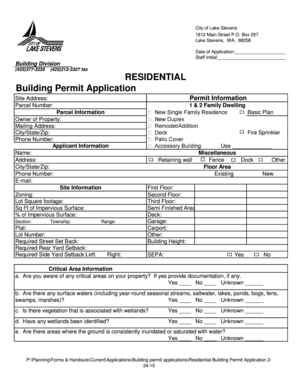

A credit application form PDF is a document used by individuals or companies to apply for credit. It is a convenient and standardized format that allows applicants to provide the necessary information required by lenders or creditors. The credit application form PDF typically includes personal and financial details, such as name, address, employment history, income, and expenses. By filling out this form, applicants are able to provide comprehensive information for lenders to evaluate their creditworthiness and make informed decisions regarding granting credit.

What are the types of credit application form pdf?

There are various types of credit application form PDF that cater to different purposes or industries. Some common types include: 1. Personal Credit Application Form: Used by individuals to apply for personal loans or credit cards. 2. Business Credit Application Form: Used by businesses to apply for credit lines or loans. 3. Mortgage Credit Application Form: Used specifically for mortgage or home loan applications. 4. Auto Loan Credit Application Form: Used by individuals who wish to apply for auto loans. 5. Student Loan Credit Application Form: Used by students to apply for financial aid or student loans. These are just a few examples, as there may be variations based on specific lending institutions or regulatory requirements.

How to complete credit application form pdf

Completing a credit application form PDF is a simple process that requires attention to detail and accuracy. Here are the steps to follow: 1. Download the credit application form PDF from a trusted source or request it from the lender or creditor. 2. Open the PDF file using a reliable PDF editor like pdfFiller. 3. Read the instructions carefully and begin filling out the required fields, such as personal information, employment details, financial information, and references. 4. Ensure that all the information provided is accurate and up to date. 5. Double-check the form for any missing or incomplete sections, and make sure to provide all the necessary supporting documents. 6. Once completed, save the filled credit application form PDF and consider submitting it electronically if the option is available. If not, print the form and submit a hard copy through the designated channels. Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

By following these steps and utilizing the features of pdfFiller, users can easily complete credit application form PDFs accurately and efficiently.