Credit Card Payment Authorization Template

What is Credit Card Payment Authorization Template?

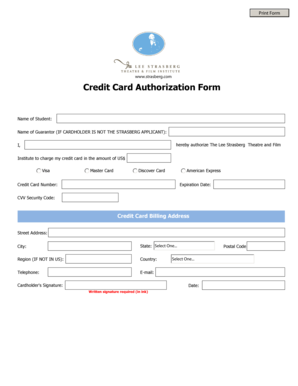

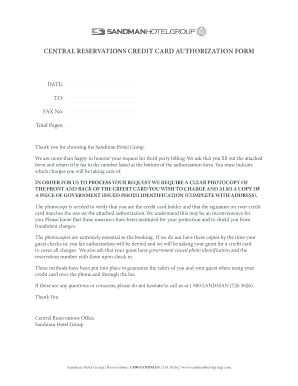

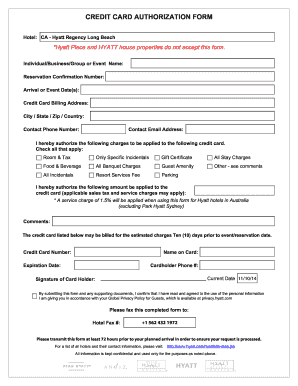

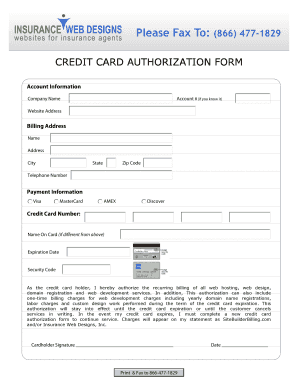

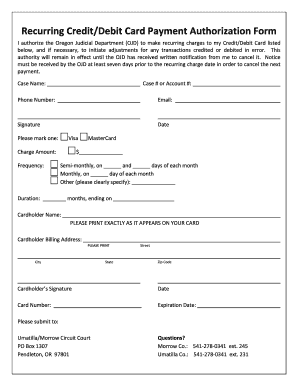

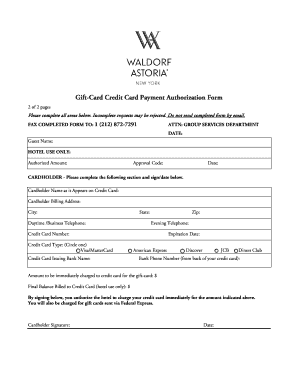

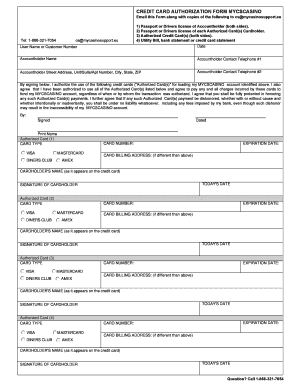

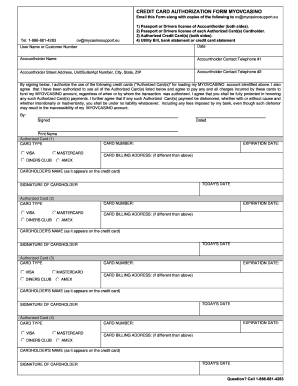

Credit Card Payment Authorization Template is a document that allows a merchant to charge a customer's credit card for a specific amount. It serves as an authorization from the cardholder to the merchant, giving the merchant permission to make the charge. This template typically includes the cardholder's information, the credit card details, the amount to be charged, and the signature of the cardholder.

What are the types of Credit Card Payment Authorization Template?

There are several types of Credit Card Payment Authorization Templates available depending on the specific purpose. Some common types include:

How to complete Credit Card Payment Authorization Template

Completing a Credit Card Payment Authorization Template is a straightforward process. Follow these steps:

pdfFiller is a powerful online platform that allows users to easily create, edit, and share Credit Card Payment Authorization Templates. With unlimited fillable templates and robust editing tools, pdfFiller is the ultimate PDF editor for efficiently managing your documents and authorization processes.