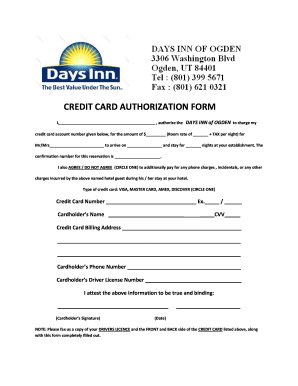

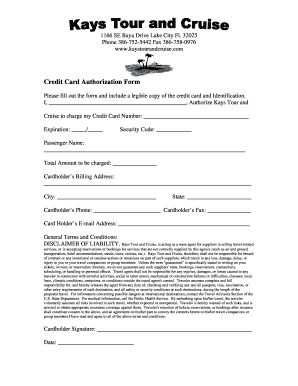

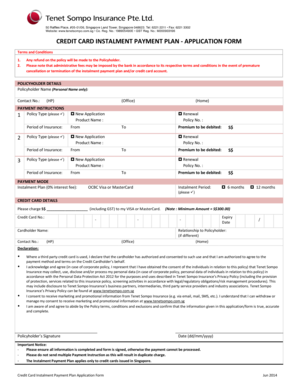

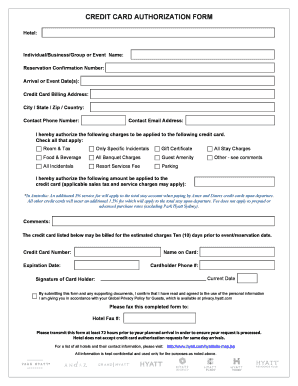

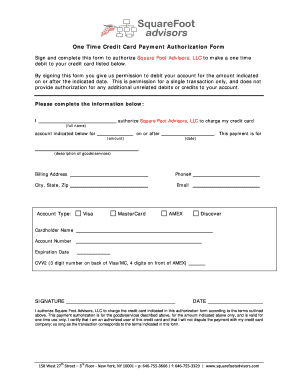

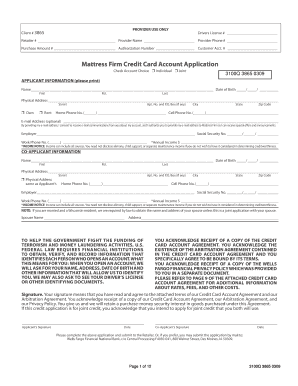

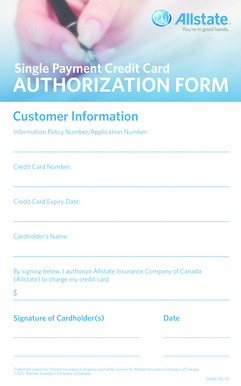

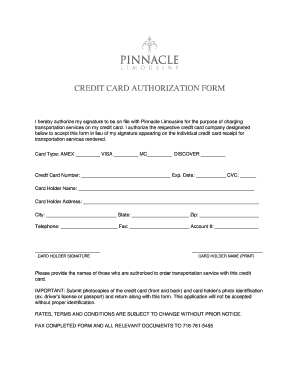

Credit Card Payment Terms And Conditions Template

Terms and conditions can assist you with many different aspects of running your organization. They enable you to prevent possible legal disputes, save time, and strengthen your company’s reputation. With a simple online template, it is easy to create this kind of agreement for your clients. pdfFiller offers editable Credit Card Payment Terms And Conditions samples with industry-specific provisions to ensure your company has the proper legal protection. Choose the form that best suits your company needs and complete it in our convenient document editor.

What is Credit Card Payment Terms And Conditions Template?

A Credit Card Payment Terms And Conditions Template is a pre-designed document that outlines the specific terms and conditions that apply to credit card payments. These templates typically include information such as payment due dates, late fees, interest rates, and dispute resolution procedures.

What are the types of Credit Card Payment Terms And Conditions Template?

There are several types of Credit Card Payment Terms And Conditions Templates available, each tailored to different needs and preferences. Some common types include:

How to complete Credit Card Payment Terms And Conditions Template

Completing a Credit Card Payment Terms And Conditions Template is a straightforward process. Follow these steps to ensure all necessary information is included:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.