Document Retention Policy California

What is document retention policy california?

Document retention policy in California refers to the specified length of time that businesses are required by law to retain certain documents and records. These policies are put in place to ensure compliance with legal and regulatory requirements, as well as to facilitate the efficient management and retrieval of important business information. In California, document retention policies may vary depending on the nature of the business and the type of documents involved.

What are the types of document retention policy california?

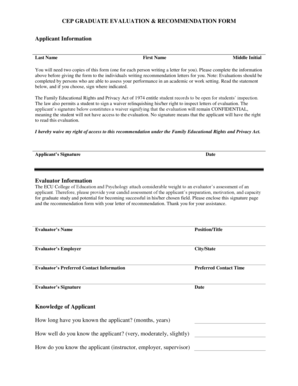

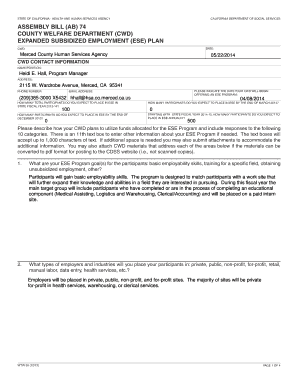

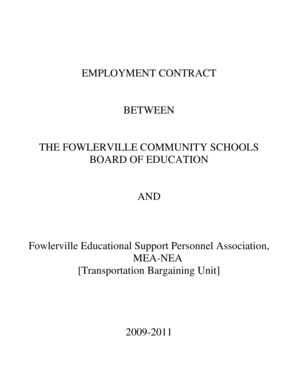

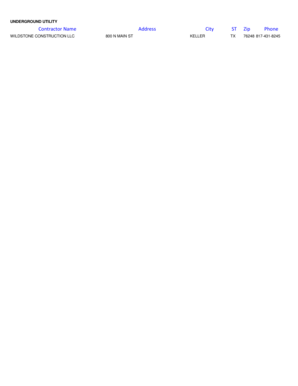

In California, there are several types of document retention policies that businesses may need to consider. Some common types include: 1. Financial Documents: These include tax returns, financial statements, bank records, and payroll records. 2. Legal Documents: This category includes contracts, agreements, intellectual property records, and litigation-related documents. 3. Personnel Records: Employee files, job applications, performance reviews, and payroll records fall under this category. 4. Medical Records: Healthcare providers are required to retain patient medical records for specific periods of time. 5. Insurance Records: Insurance policies, claims records, and accident reports are some examples of documents that should be retained according to specific guidelines.

How to complete document retention policy california

Completing a document retention policy in California involves the following steps: 1. Identify Applicable Laws: Familiarize yourself with the relevant federal, state, and industry-specific regulations regarding document retention. 2. Determine Document Categories: Categorize your documents based on their type and purpose. 3. Establish Retention Periods: Determine the length of time each category of document should be retained based on legal and operational requirements. 4. Implement a System: Develop a system for organizing, storing, and retrieving documents to ensure compliance with the retention policy. 5. Train Employees: Provide training to employees on the policies and procedures related to document retention. 6. Regularly Review and Update: Periodically review and update your document retention policy to ensure it remains current and effective.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.