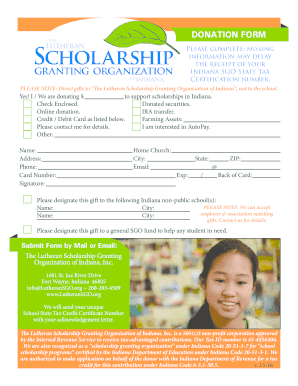

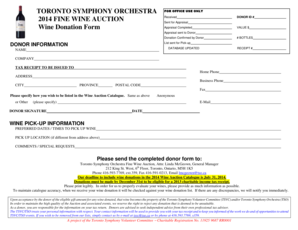

What is donation form receipt?

A donation form receipt is a document provided to donors as a proof of their contribution. It serves as an acknowledgement of their donation and can be used for tax deduction purposes. This receipt includes important information such as the name and contact details of the donor, the amount donated, the date of donation, and the nonprofit organization's information. By issuing a donation form receipt, organizations can show their appreciation to donors and build trust and transparency in their fundraising efforts.

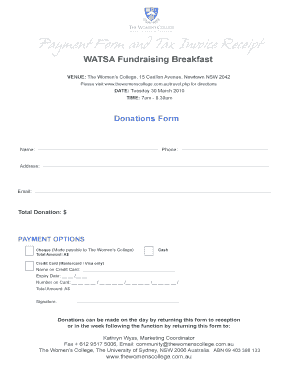

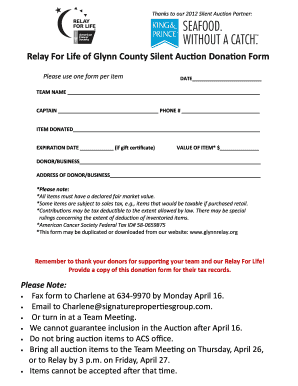

What are the types of donation form receipt?

There are two common types of donation form receipts:

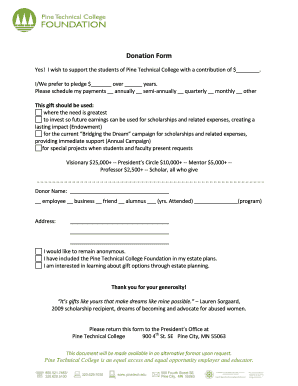

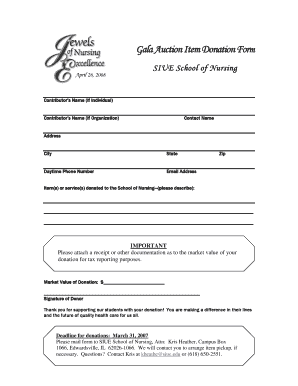

Standard Receipt: This type of receipt includes the essential details such as the donor's name, donation amount, date, and organization's information. It is suitable for individual donations or small contributions.

Detailed Receipt: A detailed receipt provides more comprehensive information about the donation. It may include additional details such as the purpose of the donation, specific projects or campaigns it supports, and any benefits the donor may receive in return. This type of receipt is often used for larger contributions or corporate donations.

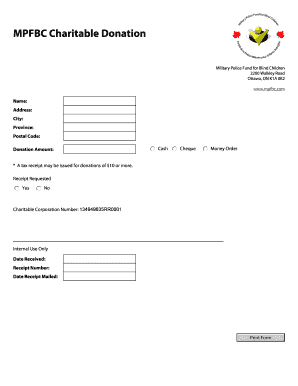

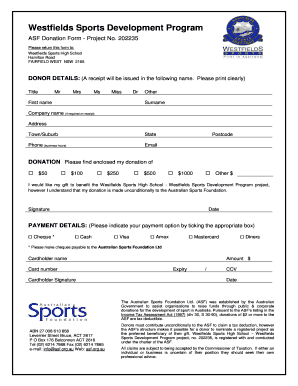

How to complete donation form receipt

Completing a donation form receipt is an easy process that ensures accurate documentation. Here are the steps to follow:

01

Obtain the template: Start by obtaining a donation form receipt template. You can get one from pdfFiller, which empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.

02

Fill in the donor's information: Enter the donor's name, address, and contact details on the receipt. If applicable, include any additional information required for tax purposes.

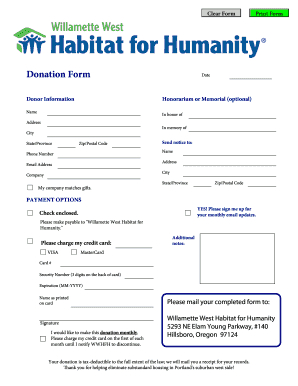

03

Record the donation details: Include the amount donated, the date of donation, and any specific instructions or designations for the funds.

04

Add organization's information: Provide the nonprofit organization's name, address, and contact details. This information should be easily accessible to donors.

05

Make it personalized: Add a thank-you note or a personalized message to acknowledge the donor's contribution and express gratitude.

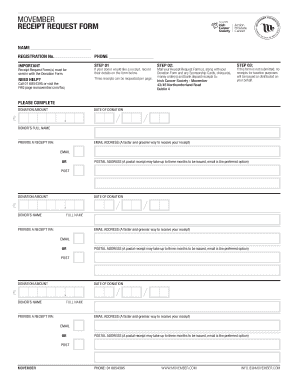

06

Double-check and sign: Review all the information on the receipt for accuracy and completeness. Make sure all necessary fields are filled, and then sign the receipt to make it official.

By following these steps, you can effectively complete a donation form receipt and ensure proper record-keeping and legal compliance.