Donation Receipt Template Doc

What is a donation receipt template doc?

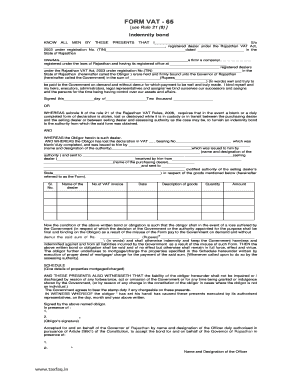

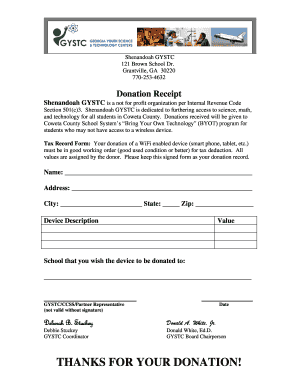

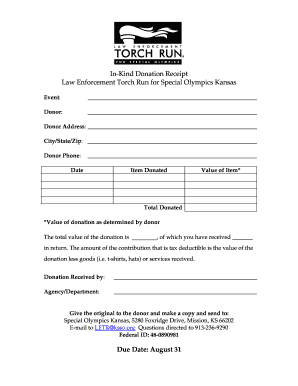

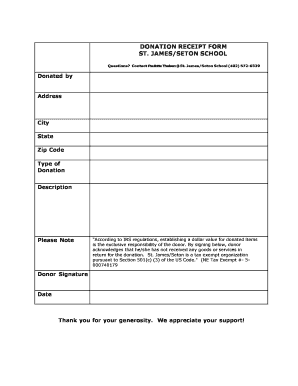

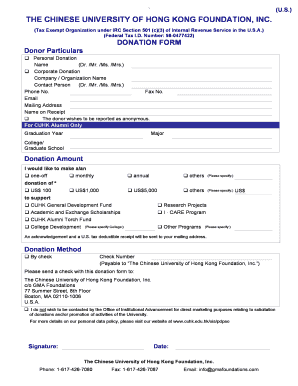

A donation receipt template doc is a pre-designed document that can be used to create personalized receipts for donations. It provides a professional and organized format for acknowledging and recording donations received by individuals or organizations. By using a donation receipt template doc, users can easily generate receipts that include crucial information such as the donor's name, donation amount, date, and any special notes.

What are the types of donation receipt template doc?

There are various types of donation receipt template docs available, catering to different formats and purposes. Some common types include:

How to complete a donation receipt template doc

Completing a donation receipt template doc is a straightforward process. Here are the steps to follow:

pdfFiller is an exceptional online platform that empowers users to effortlessly create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor users need to efficiently manage their documents. Whether it's creating a donation receipt template doc or any other type of document, pdfFiller simplifies the entire process, saving time and ensuring professionalism.