What is donation receipt template pdf?

A donation receipt template in PDF format is a pre-designed document that organizations use to provide a record of a donation from a donor. It includes important details such as the name and address of the donor, the date and amount of the donation, and the organization's information. The template is formatted in PDF to ensure that it can be easily shared and printed.

What are the types of donation receipt template pdf?

There are several types of donation receipt templates available in PDF format to suit different needs. These include:

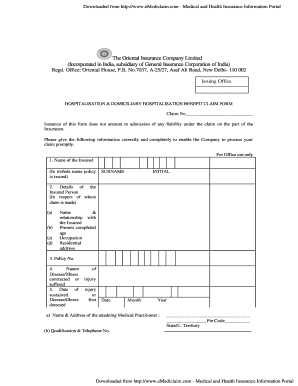

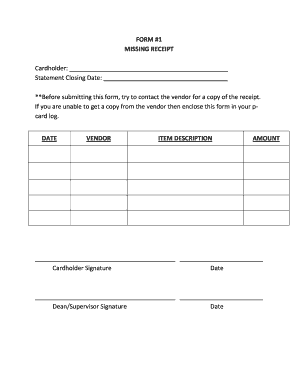

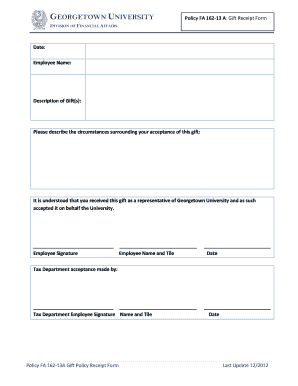

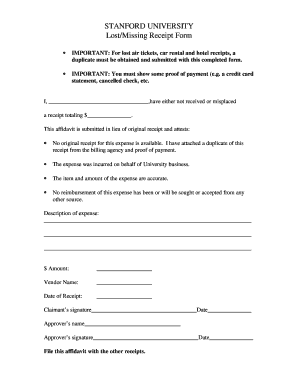

Standard donation receipt template: A basic template that includes all the necessary information about the donation.

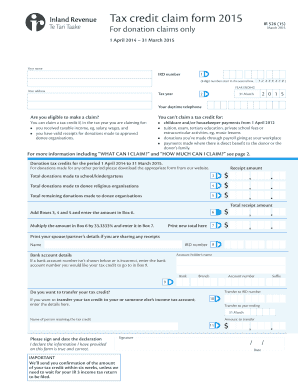

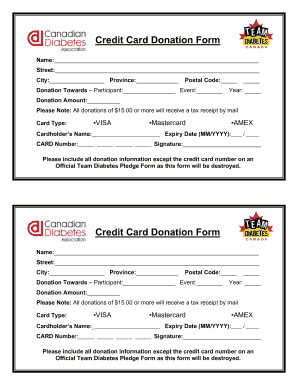

Tax-exempt donation receipt template: Specifically designed for tax-exempt organizations, this template includes additional details required for tax purposes.

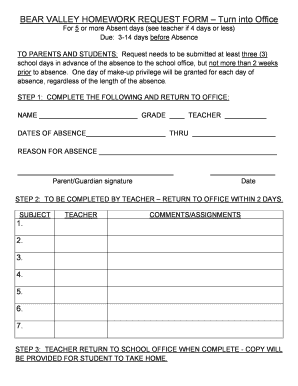

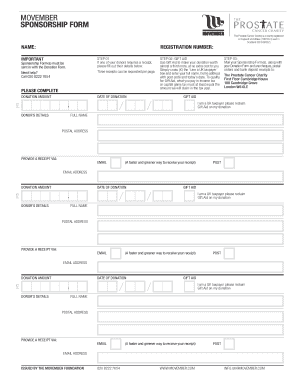

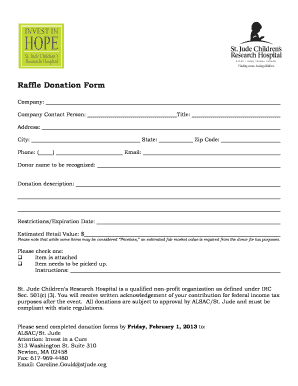

Event donation receipt template: Used for donations received at fundraising events or charity auctions, this template includes fields to capture event-specific details.

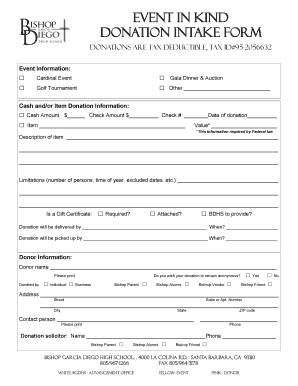

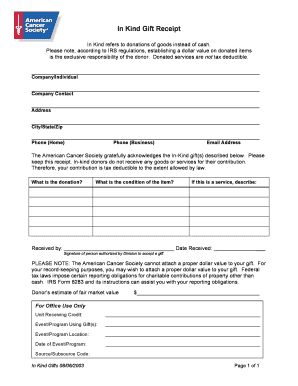

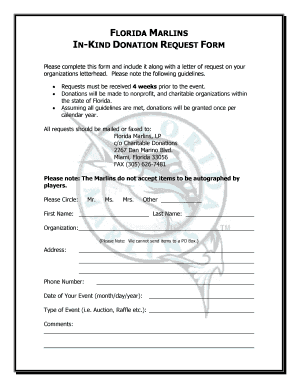

In-kind donation receipt template: Used when receiving non-monetary donations such as goods or services, this template includes sections to describe the donated items.

Recurring donation receipt template: Designed for recurring donors, this template automatically generates receipts for regular donations.

Acknowledgement letter for donation: Not a receipt template per se, but a template used to acknowledge and thank donors for their contributions.

How to complete donation receipt template pdf

Completing a donation receipt template in PDF format is easy and straightforward. Here are the steps:

01

Open the donation receipt template PDF in a PDF editor or online editing tool.

02

Fill in the organization's name, address, and contact information.

03

Enter the donor's name, address, and contact information.

04

Specify the donation date and amount.

05

Provide details or remarks about the donation if necessary.

06

Review the completed receipt for accuracy.

07

Save the document and share it with the donor in PDF format.

pdfFiller is a powerful online tool that empowers users to create, edit, and share documents in PDF format, including donation receipt templates. With unlimited fillable templates and robust editing tools, pdfFiller is the go-to PDF editor for getting your documents done efficiently.