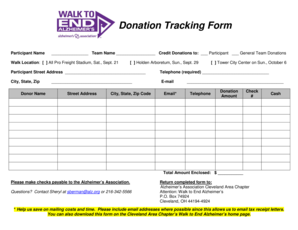

Donation Tracking Form - Page 2

What is Donation Tracking Form?

A Donation Tracking Form is a document that allows individuals or organizations to track and record the details of their donations. It provides a convenient way to keep a record of the donation amount, date, recipient, and any other relevant information. This form can be used for various purposes, such as personal donation tracking, fundraising campaigns, or keeping track of donations made to charitable organizations.

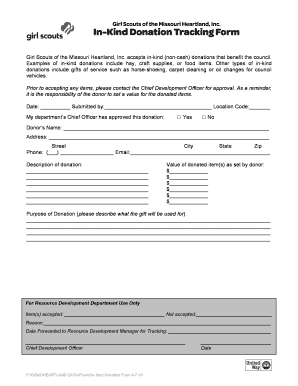

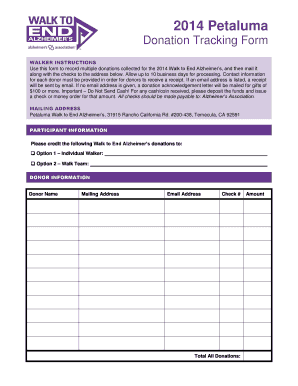

What are the types of Donation Tracking Form?

There are several types of Donation Tracking Forms available to cater to different needs and requirements. Some common types include:

How to complete Donation Tracking Form

Completing a Donation Tracking Form is a simple and straightforward process. Just follow these steps:

With pdfFiller, you can easily create, edit, and share Donation Tracking Forms online. Its unlimited fillable templates and powerful editing tools make it the only PDF editor you need to get your documents done efficiently.