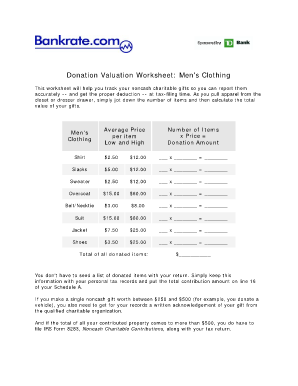

Clothing Donation Tax Deduction Worksheet

What is clothing donation tax deduction worksheet?

A clothing donation tax deduction worksheet is a document that helps individuals keep track of their donated clothing items and calculate their tax deductions. It allows you to record details such as the type of clothing donated, its condition, and its estimated value.

What are the types of clothing donation tax deduction worksheet?

There are several types of clothing donation tax deduction worksheets available, depending on the specific requirements of the tax authorities in your country. Some common types include:

How to complete clothing donation tax deduction worksheet

Completing a clothing donation tax deduction worksheet is a straightforward process. Here are the steps you need to follow:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.