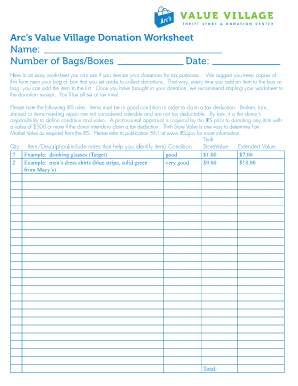

What is goodwill donation calculator?

A goodwill donation calculator is a tool that helps individuals determine the value of their donated items when assessing their tax deductions. It takes into account various factors such as the condition of the items, their age, and the fair market value. By using a goodwill donation calculator, users can ensure that they accurately calculate the value of their donations and claim the appropriate deductions.

What are the types of goodwill donation calculator?

There are several types of goodwill donation calculators available to users. Here are some common ones:

Online goodwill donation calculator: These calculators are web-based and can be accessed from any device with an internet connection. They often provide a user-friendly interface and guide users through the process of calculating their donations.

Mobile apps: Many organizations have developed mobile apps that offer goodwill donation calculators. These apps allow users to calculate their donations on the go.

Spreadsheet templates: Some users prefer to use spreadsheet templates, such as Excel or Google Sheets, to calculate their donations. These templates often come with pre-built formulas and can be customized to suit individual needs.

Tax software: Certain tax preparation software also includes goodwill donation calculators as a feature. Users can input their donation information directly into the software and have their deductions automatically calculated.

How to complete goodwill donation calculator

Completing a goodwill donation calculator is relatively simple. Here's a step-by-step guide to help you through the process:

01

Gather information: Collect all the necessary information about your donated items, such as their descriptions, conditions, ages, and fair market values. Make sure to keep any supporting documentation, such as receipts or appraisals, handy.

02

Choose a calculator: Select the type of goodwill donation calculator that suits your preferences. You can choose between online calculators, mobile apps, spreadsheet templates, or tax software.

03

Enter the details: Enter the required information into the calculator. This may include item descriptions, conditions, quantities, and fair market values. Follow the prompts and provide accurate information.

04

Calculate the value: Let the calculator process the information and calculate the total value of your donations. It may provide you with an itemized list of each item's value as well as the overall deduction amount.

05

Keep records: Make sure to keep a copy of the completed donation calculator for your records. You may need it when filing your tax return or if asked to provide documentation by the IRS.

06

Consult a tax professional: If you have any doubts or questions regarding your donation deductions, it's always a good idea to consult a tax professional who can provide guidance and ensure you're maximizing your tax benefits.

07

Submit your tax return: Include the total value of your donations as calculated by the goodwill donation calculator on your tax return. Don't forget to follow the appropriate procedures and deadlines for filing your taxes.

pdfFiller, the leading online document management platform, empowers users to create, edit, and share documents online efficiently. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that users need to get their documents done seamlessly.