Employee Payroll Change Form

What is employee payroll change form?

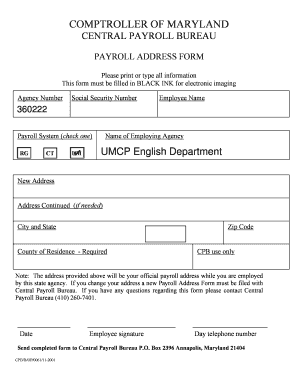

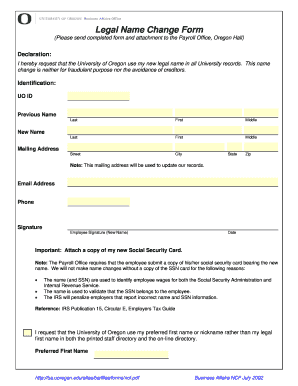

An employee payroll change form is a document used by employers to collect information and make changes to an employee's payroll record. This form is typically used when an employee experiences a change in their personal information, such as a change of address, name, or bank account details. It is important for employers to accurately update this information in order to ensure employees are paid correctly and on time.

What are the types of employee payroll change form?

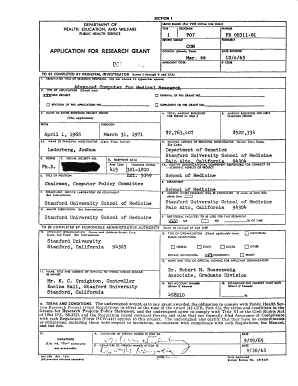

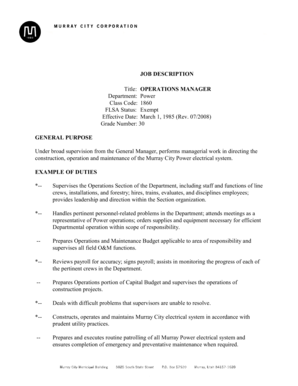

There are several types of employee payroll change forms that may be used depending on the specific changes needed. Some common types include: 1. Personal Information Change Form: Used for updating personal details such as name, address, and contact information. 2. Bank Account Change Form: Used to update an employee's banking details for direct deposit purposes. 3. Tax Withholding Form: Used to adjust the amount of taxes withheld from an employee's paycheck. 4. Salary Change Form: Used when there is a change in an employee's salary or hourly rate. It is important to use the correct form for the specific change being made to ensure accuracy and compliance with company policies and legal requirements.

How to complete employee payroll change form

Completing an employee payroll change form is a straightforward process. Follow these steps to ensure accuracy and completeness: 1. Obtain the correct form: Identify the specific type of change that needs to be made and obtain the corresponding form. 2. Provide employee information: Fill in the employee's name, employee ID or social security number, and any other required identification details. 3. Enter change details: Clearly document the specific changes being made, such as the new address, updated banking information, or revised salary details. 4. Attach supporting documents: If required, attach any supporting documents such as proof of address change or updated bank account information. 5. Review and submit: Double-check the completed form for accuracy and completeness before submitting it to the appropriate department or person. By following these steps, you can ensure that the employee payroll change form is completed correctly and efficiently.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.