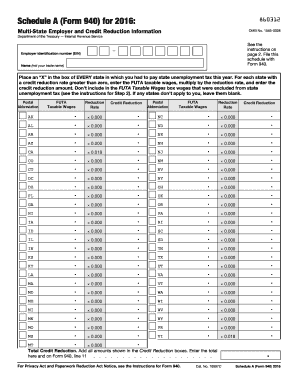

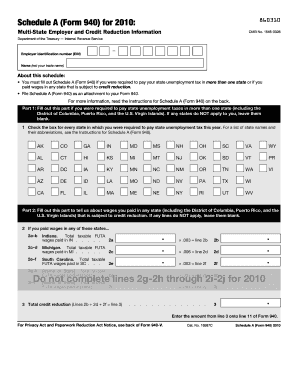

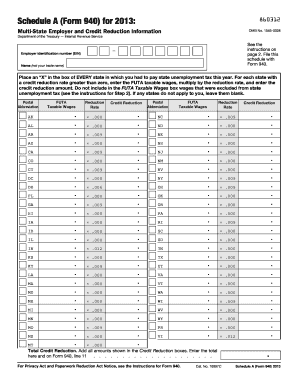

Schedule A (940 Form)

What is Schedule A (940 Form)?

Schedule A (940 Form) is a document that accompanies Form 940, which is used by employers to report their annual federal unemployment tax liabilities. Schedule A provides detailed information about the employer's state unemployment tax liabilities and credits.

What are the types of Schedule A (940 Form)?

There are two main types of Schedule A (940 Form): State Certification and State Filing. The State Certification section is used to report the state unemployment tax liabilities, while the State Filing section is used to report any adjustments or credits.

How to complete Schedule A (940 Form)

To complete Schedule A (940 Form), follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.