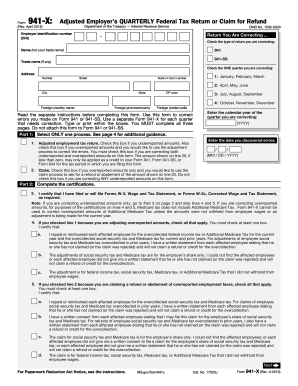

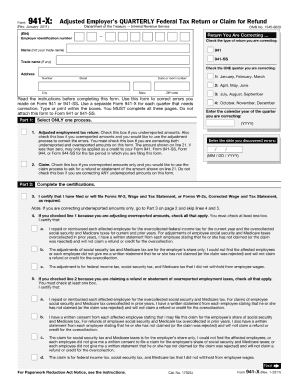

941-X Form

What is 941-X Form?

The 941-X Form is a document used by employers to correct errors on previously filed Form 941, which is the Employer's Quarterly Federal Tax Return. It allows employers to make amendments and adjustments to their quarterly tax filings.

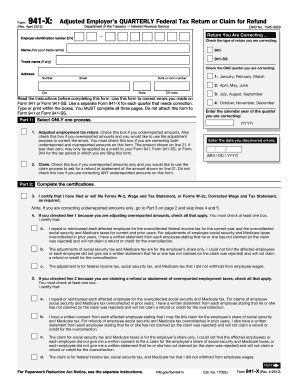

What are the types of 941-X Form?

There are three types of 941-X Form that employers may encounter:

941-X Form for correcting wage and tax amounts

941-X Form for correcting tax liability

941-X Form for correcting adjustments

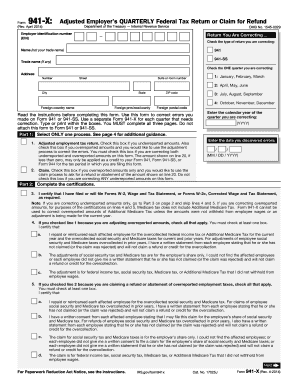

How to complete 941-X Form

Completing the 941-X Form may seem daunting, but with the right information, it can be done efficiently. Here are the steps to complete the form:

01

Gather all necessary information and documents, including the original Form 941 that needs correction.

02

Fill out the basic identifying information on the 941-X Form, such as the employer's name, address, and EIN.

03

Indicate the quarter and year that the original Form 941 was filed for, and provide the reasons for the correction.

04

Correct the specific lines that need adjustment, including wage and tax amounts or tax liability.

05

Attach any supporting documentation that explains and justifies the corrections made.

06

Sign and date the 941-X Form.

07

Submit the completed form to the appropriate address as instructed.

08

Keep a copy of the form and any supporting documents for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 941-X Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is there a deadline for filing form 941-X for ERC?

This form must be filed within three years after the date you filed your first return or two years after you paid the tax, whichever comes first. For instance, if all Forms 941 are filed by April 15th of the following year, they are considered filed on that date.

Where are 941x forms mailed to?

Where to mail Form 941? Return without paymentReturn with paymentInternal Revenue Service, P.O. Box 409101, Ogden, UT 84409Internal Revenue Service, P.O. Box 932100, Louisville, KY 40293-2100The IRS Recommends filers to e-file form 941 for quick processing. E-File Now

How do I fill out a 941x?

This is how to fill out a 941-X ERC Form. Fill in the required details on the page header, such as the EIN number, quarter, company name, and year. Find which payroll quarters in 2020 and 2021 your association was qualified for. For each quarter you prepare for, gather your earlier 941, payroll logs, and a blank 941-X.

Can 941x be filed electronically?

You can e-file any of the following employment tax forms: 940, 941, 943, 944 and 945. Benefits to e-filing: It saves you time. It is secure and accurate.

How do I file a corrected 941x?

When you discover an error on a previously filed Form 941, you must: Correct that error using Form 941-X. File a separate Form 941-X for each Form 941 that you're correcting. and. Generally, file Form 941-X separately. Don't file Form 941-X with Form 941.

Can a 941x be submitted electronically?

You can e-file any of the following employment tax forms: 940, 941, 943, 944 and 945. Benefits to e-filing: It saves you time. It is secure and accurate.