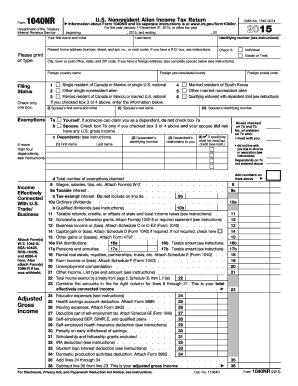

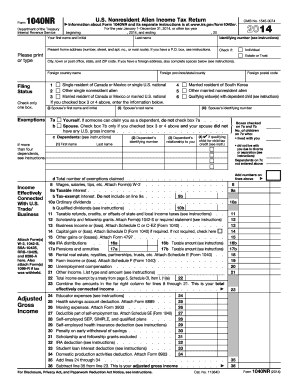

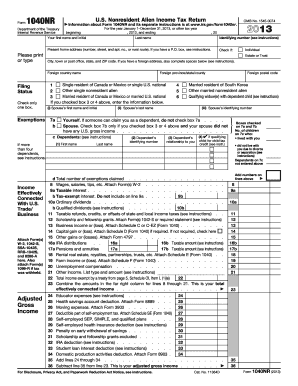

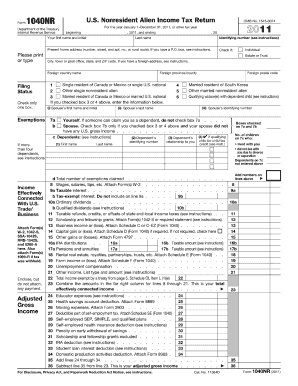

1040NR Form

What is 1040NR Form?

The 1040NR Form is a tax form used by non-resident aliens or foreigners who have engaged in business activities or earned income in the United States. It is designed specifically for individuals who do not qualify as U.S. residents for tax purposes. The purpose of this form is to report income, deductions, and tax liability for non-residents.

What are the types of 1040NR Form?

There are two primary types of 1040NR Form: the 1040NR-EZ and the regular 1040NR. The 1040NR-EZ is a simplified version designed for individuals who meet certain requirements, such as having no dependents and only having income from wages, salaries, tips, scholarships, or fellowships. The regular 1040NR is for individuals who don't qualify for the 1040NR-EZ and have more complex tax situations, such as having dependents or additional sources of income or deductions.

How to complete 1040NR Form

To complete the 1040NR Form, follow these steps:

It's important to note that the process for completing the 1040NR Form may vary depending on individual circumstances. It is always recommended to consult with a tax professional or refer to the IRS instructions for detailed guidance. With pdfFiller, you can easily complete and submit your 1040NR Form online. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and effectively.