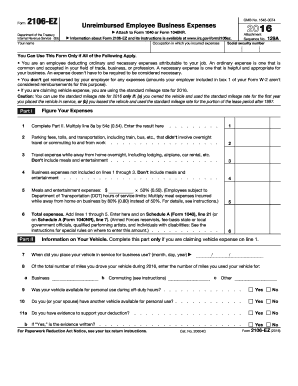

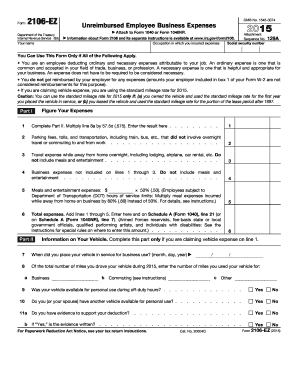

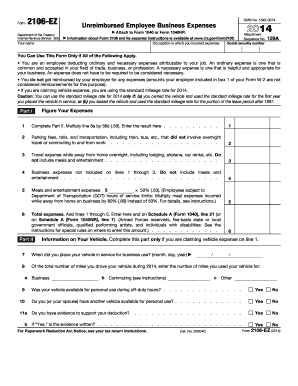

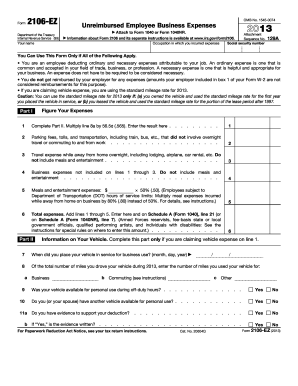

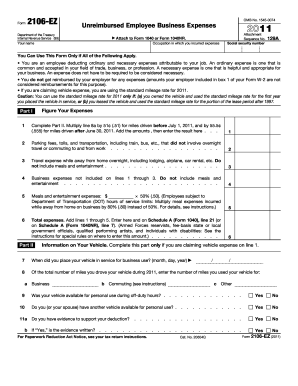

2106-EZ Form

What is 2106-EZ Form?

The 2106-EZ Form is a simplified version of the standard Form 2106 used by taxpayers to report employee business expenses. This form is specifically designed for individuals who are eligible to deduct ordinary and necessary expenses they incurred while performing their job duties. By using the 2106-EZ Form, taxpayers can streamline their reporting process and save time.

What are the types of 2106-EZ Form?

There is only one type of 2106-EZ Form, which is the simplified version mentioned earlier. This form is meant for individual taxpayers who meet the eligibility criteria for deducting employee business expenses. It is important to note that not all taxpayers will qualify for this deduction, so it's crucial to review the instructions and consult a tax professional if needed.

How to complete 2106-EZ Form

Completing the 2106-EZ Form is a straightforward process that can be done in a few simple steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.