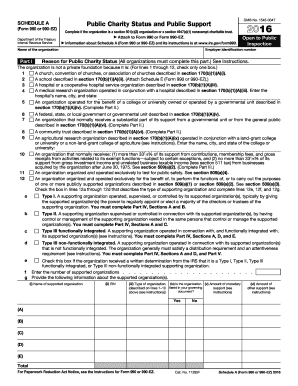

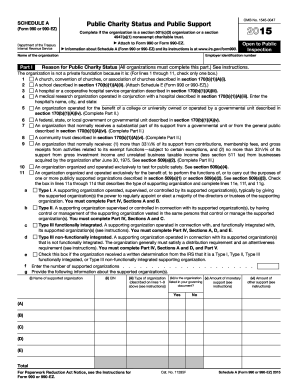

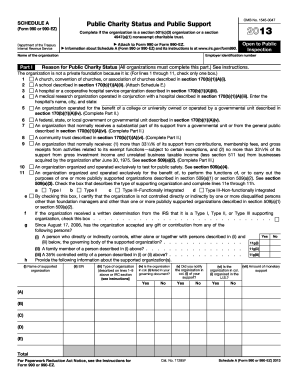

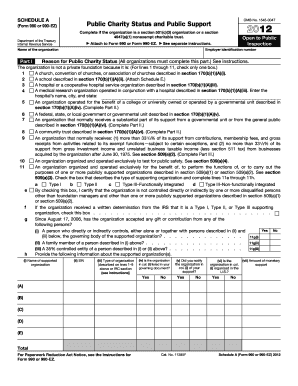

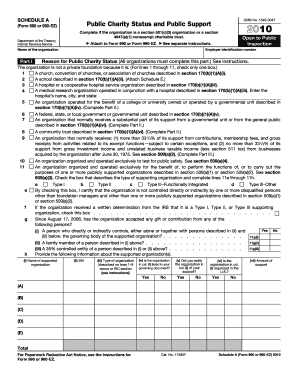

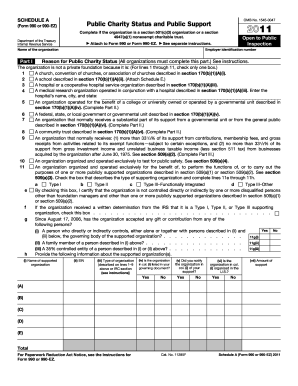

Schedule A (990 Form)

What is Schedule A (990 Form)?

Schedule A (990 Form) is a document used by non-profit organizations in the United States to provide information about their public charity status and certain activities they engage in. It is an attachment to the annual informational tax return, Form 990, which is filed with the Internal Revenue Service (IRS). This schedule helps organizations demonstrate their eligibility for tax-exempt status and provides transparency to the public regarding their finances and operations.

What are the types of Schedule A (990 Form)?

There are two types of Schedule A (990 Form) based on the level of public support received by a non-profit organization: 1. Schedule A - Organizations Exempt Under Section 501(c)(3): This type is for public charities and private foundations that meet the criteria for exemption under section 501(c)(3) of the Internal Revenue Code. These organizations rely on public support for their operations and derive a significant portion of their income from contributions, grants, and government funding. 2. Schedule A - Organizations Described in Section 170(b)(1)(A)(vi): This type is for supporting organizations that are not public charities but are organized and operated exclusively for the benefit of specific public charities. They must meet certain requirements to qualify for this designation.

How to complete Schedule A (990 Form)

Completing Schedule A (990 Form) requires careful attention to detail and accurate reporting. Here are the steps to help you complete this form: 1. Obtain the latest version of Schedule A (990 Form) from the IRS website or reliable sources. 2. Provide the basic information about your organization, such as its name, address, and Employer Identification Number (EIN). 3. Determine the type of Schedule A that applies to your organization (either 501(c)(3) or 170(b)(1)(A)(vi)) and complete the corresponding section. 4. Fill in the details about your organization's public support, including contributions, grants, and government funding. 5. Provide information about your organization's activities and accomplishments during the tax year. 6. Attach any required supporting documents and explanations. 7. Review the completed form for accuracy and make any necessary corrections. 8. Sign and date the form before submitting it along with your Form 990 to the IRS.

pdfFiller is a powerful online tool that empowers users to create, edit, and share documents in various formats, including PDF. With unlimited fillable templates and robust editing tools, pdfFiller simplifies the process of completing complex forms like Schedule A (990 Form). Whether you need to fill out, edit or share your forms, pdfFiller has everything you need to efficiently manage your documents.