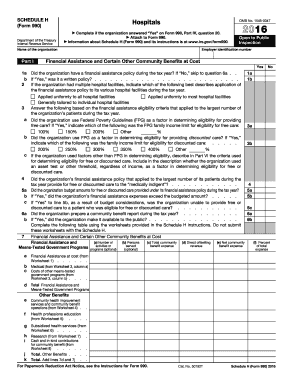

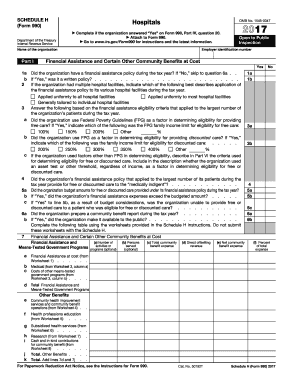

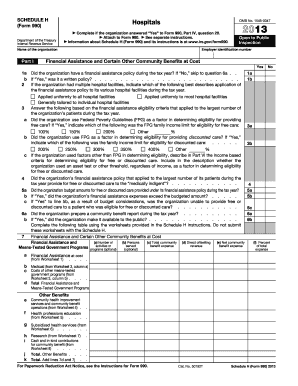

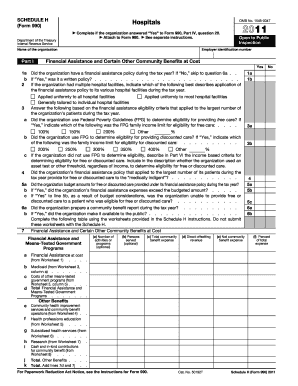

Schedule H (990 Form)

What is Schedule H (990 Form)?

Schedule H (990 Form) is a crucial document required by the IRS for organizations that operate hospitals and other healthcare facilities. It is used to report information about the organization's activities related to community benefit programs, charity care, and other healthcare services.

What are the types of Schedule H (990 Form)?

There are two main types of Schedule H (990 Form) that organizations may need to complete:

Part I - Hospitals

Part II - Other Healthcare Organizations

How to complete Schedule H (990 Form)

To successfully complete Schedule H (990 Form) and ensure compliance with IRS regulations, follow these steps:

01

Gather all necessary financial and operational data related to community benefit programs, charity care, and healthcare services.

02

Carefully review the instructions provided by the IRS for each part of Schedule H.

03

Enter the required information accurately and double-check all figures for accuracy.

04

Submit the completed Schedule H (990 Form) along with the organization's annual 990 filing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I file IRS Form 990 extension?

Use Form 8868, Application for Extension of Time To File an Exempt Organization ReturnPDF, to request a 6-month automatic extension of time to file any of the following returns: Form 990, Return of Organization Exempt from Income TaxPDF. Form 990, Return of Organization Exempt from Income TaxPDF.

How do I electronically file a 990 extension?

Form 990 - Filing an Extension Form 8868 From within your TaxAct return (Online or Desktop), click Filing to expand, then click File Extension. The program will continue with the interview questions to help you complete the required information for an extension request.

Can IRS Form 990 be filed electronically?

For tax years ending before July 31, 2021, the IRS will accept either paper or electronic filing of Form 990-EZ, Short Form Return of Organization Exempt from Income Tax. For tax years ending July 31, 2021, and later, Forms 990-EZ must be filed electronically.

How do I file a 990 tax return?

0:10 2:31 Learn How to Fill the Form 990 Return of Organization Exempt - YouTube YouTube Start of suggested clip End of suggested clip Report all revenue your organization has received over the past tax year and the current tax yearMoreReport all revenue your organization has received over the past tax year and the current tax year you are reporting. Next report all expenses the organization has incurred during both the previous.

Can you do a 990 in TurboTax?

No, unfortunately, TurboTax does not support Form 990 and its variants.

Is Schedule B required for 990?

Generally, a NPO must attach Schedule B to its Form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor. There are special rules for certain 501(c)(3) NPOs that may raise the reporting threshold above $5,000.

Related templates