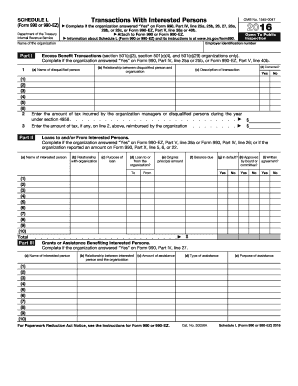

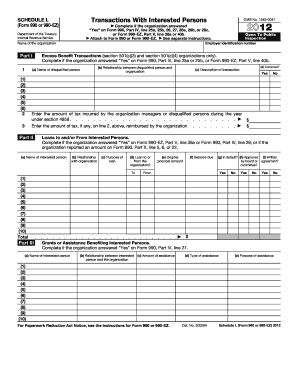

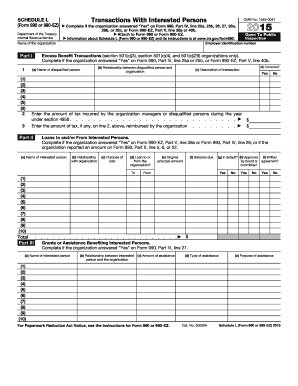

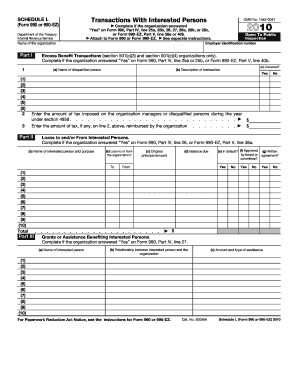

Schedule L (990 Form)

What is Schedule L (990 Form)?

Schedule L (990 Form) is a supplementary schedule that must be filed with Form 990 by certain tax-exempt organizations. It provides information on the organization's financial transactions and balances with related parties.

What are the types of Schedule L (990 Form)?

There are two types of Schedule L (990 Form):

Schedule L, Part I - Transactions with Related Organizations

Schedule L, Part II - Transactions with Interested Persons

How to complete Schedule L (990 Form)

To complete Schedule L (990 Form), follow these steps:

01

Gather all relevant financial information related to transactions with related organizations or interested persons.

02

Fill in the details of each transaction, including the name of the organization or person involved, the nature of the transaction, the amount, and any other required information.

03

Ensure all calculations are accurate and double-check for any errors or omissions.

04

Attach Schedule L to Form 990 and submit it to the appropriate tax authority.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Schedule L (990 Form)

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Who must file a Schedule L?

Schedule L is only used by taxpayers who are increasing their standard deduction by reporting state or local real estate taxes, taxes from the purchase of a new motor vehicle, or from a net disaster loss reported on Form 4684.

What is reported on Schedule L?

Schedule L (Form 990) is used by an organization that files Form 990 or 990-EZ to provide information on certain financial transactions or arrangements between the organization and disqualified person(s) under section 4958 or other interested persons.

What goes on Schedule I of a 990?

Schedule I (Form 990) is used by an organization that files Form 990 to provide information on grants and other assistance made by the filing organization during the tax year to domestic organizations, domestic governments, and domestic individuals. Report activities conducted by the organization directly.

How do you complete Schedule L?

Completing a Schedule L In the first part of the schedule, enter assets such as cash, accounts receivable, investments and buildings. Next, enter liabilities such as accounts payable and wages owed. Last, enter the net income for the year and stockholder's equity.

What is reported on Schedule L balance sheets per books?

Basically, a Schedule L - Balance Sheet contains the Assets which equals the Liabilities and Equity (Capital Stock, Paid in Capital and Retained Earnings) that existed in the corporation on the first and last day of the tax year.

Do I have to file Schedule L?

Schedule L Requirements If the S corporation's total receipts and total assets at the close of the tax year amount to $250,000 or more, then you must complete the schedule L section of the form that includes a detailed summary of everything on the balance sheet.

Related templates