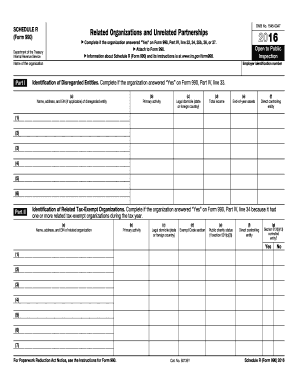

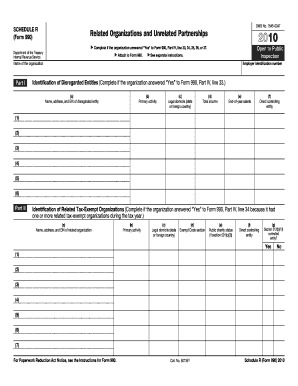

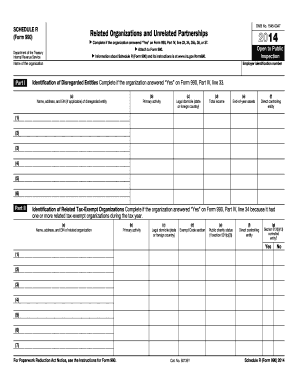

Schedule R (990 Form)

What is Schedule R (990 Form)?

Schedule R (990 Form) is a supplementary form that must be filed by certain tax-exempt organizations that have related organizations and engage in certain transactions.

What are the types of Schedule R (990 Form)?

There are two types of Schedule R (990 Form): Schedule R (Form 990) and Schedule R (Form 990-EZ).

Schedule R (Form is used by large tax-exempt organizations to provide detailed information about their related organizations and transactions.

Schedule R (Form 990-EZ) is used by smaller tax-exempt organizations with gross receipts less than $200,000 and total assets less than $500,000.

How to complete Schedule R (990 Form)

Completing Schedule R (990 Form) can be done in a few simple steps:

01

Gather all the necessary information about your related organizations and transactions.

02

Review the instructions provided with the form to ensure you understand the requirements.

03

Fill out the form accurately and completely, providing all the required details.

04

Double-check all the information entered for any errors or omissions.

05

Submit the completed Schedule R (990 Form) along with your main tax return.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Schedule R (990 Form)

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Who must be reported on Schedule J 990?

Schedule J (Form 990) is used by an organization that files Form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization.

What is Form 990 Return of organization Exempt From Income Tax?

Purpose. Form 990 is used by tax-exempt organizations, nonexempt charitable trusts and section 527 political organizations to report income and calculate taxes owed to the federal government.

Is Form 990 Schedule B required?

Effective July 1, California's Registry of Charitable Trusts no longer required the filing of Schedule B as part of registration and annual reporting requirements.

What are the filing requirements for Form 990?

An organization that normally has $50,000 or more in gross receipts and that is required to file an exempt organization information return must file either Form 990, Return of Organization Exempt from Income TaxPDF, or Form 990-EZ, Short Form Return of Organization Exempt from Income TaxPDF.

Who is considered a key employee on 990?

If so, and if their reportable compensation from the organization and related organizations during the tax year exceeds $150,000, then they must be reported as key employees. If the organization has over 20 employees who meet these tests, then it would only report the top 20 most highly compensated as key employees.

What are the criteria for reporting compensation in Form 990?

TIP: All filing organizations (not just section 501(c)(3) organizations) must list and report compensation paid to the organization's five highest compensated employees with reportable compensation greater than $100,000 from the organization and related organizations, as well as to its five highest compensated

Related templates