Form 433-a (oic) 2016

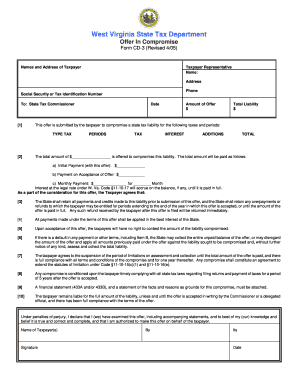

What is form 433-a (oic) 2016?

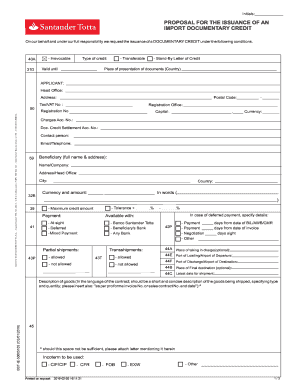

Form 433-a (OIC) is an IRS form used by taxpayers who want to submit an Offer in Compromise (OIC) to settle their tax debt for less than the full amount they owe. This form is specifically designed for individuals who are unable to pay their tax liability in full and need to propose a partial payment plan.

What are the types of form 433-a (oic) 2016?

There are two types of Form 433-a (OIC) 2016 that taxpayers may need to consider depending on their specific situation:

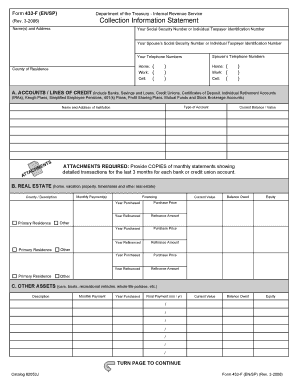

How to complete form 433-a (oic) 2016

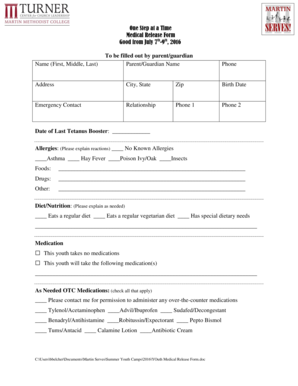

Completing Form 433-a (OIC) 2016 requires careful attention to detail and accurate reporting of financial information. Here are the steps to complete the form:

By using pdfFiller, users can easily create, edit, and share their Form 433-a (OIC) 2016 online. With unlimited fillable templates and powerful editing tools, pdfFiller provides a comprehensive solution for taxpayers in need of assistance with their tax documents.