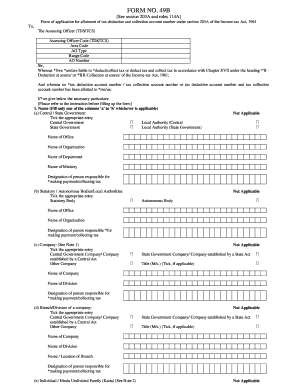

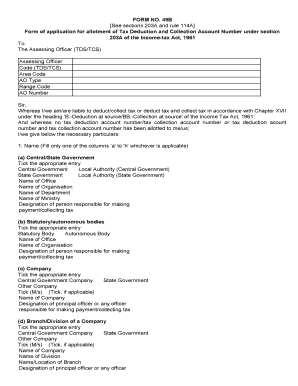

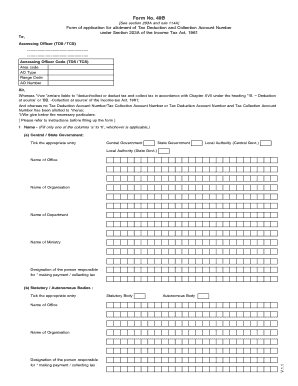

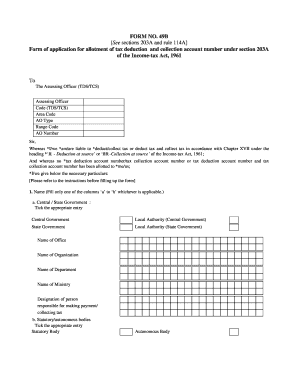

Form 49b

What is form 49b?

Form 49b is a document required by the Income Tax Department of India. It is used for the purpose of applying for a Tax Deduction and Collection Account Number (TAN). TAN is a unique 10-digit alphanumeric code that is necessary for individuals and companies to make TDS (Tax Deducted at Source) payments. This form requires various details such as the applicant's personal information, address, and details about the deductor.

What are the types of form 49b?

There are two types of form 49b: physical form and online form. The physical form can be obtained from any authorized TAN facilitation center or downloaded from the official website of the Income Tax Department. The online form can be filled on the official website of the Income Tax Department. Both types of forms serve the same purpose, but the online form offers the convenience of filling it electronically and submitting it directly online.

How to complete form 49b

Completing form 49b is a simple and straightforward process. Follow the steps below to complete the form successfully:

By using pdfFiller, users can easily create, edit, and share their form 49b online. With unlimited fillable templates and powerful editing tools, pdfFiller simplifies the entire process. Whether you prefer to fill the physical form or complete it online, pdfFiller has got you covered. Save time and effort by using pdfFiller as your go-to PDF editor for all your document needs.