What is Form 990?

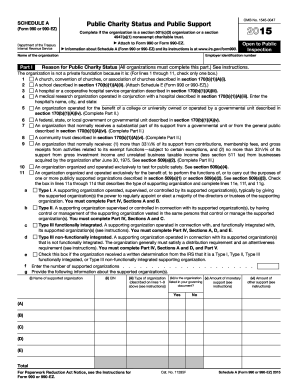

Form 990 is a tax form that nonprofit organizations need to file with the Internal Revenue Service (IRS) each year. This form provides detailed information about the organization's finances, activities, governance, and compliance with tax laws. It helps the IRS and the public understand how these organizations operate and ensure they are fulfilling their tax-exempt purposes. Filing Form 990 is crucial for maintaining transparency and accountability in the nonprofit sector.

What are the types of Form 990?

There are several types of Form 990, each tailored to different types and sizes of nonprofit organizations. The main types include:

Form 990-N (e-Postcard): Designed for small tax-exempt organizations with gross receipts under $50,000 per year. It is a simplified version of Form 990 that needs less financial information.

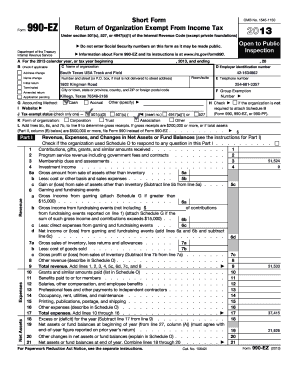

Form 990-EZ: Intended for organizations with gross receipts less than $200,000 and total assets under $500,It involves more detailed financial reporting than Form 990-N.

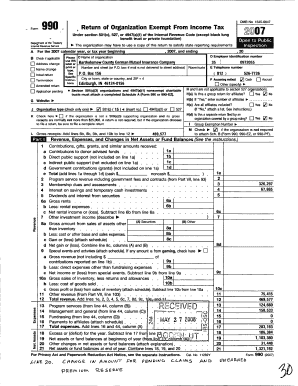

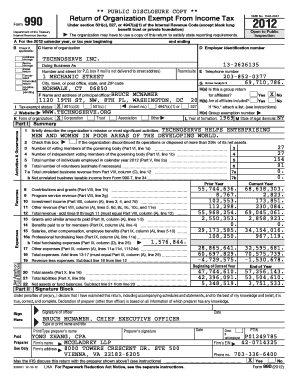

Form This is the standard form for tax-exempt organizations with gross receipts over $200,000 or total assets over $500,It requires comprehensive reporting of finances, governance, programs, and compliance.

Form 990-PF: Specific to private foundations and certain nonexempt charitable trusts. It provides detailed information on investments, distributions, and grants.

How to complete Form 990

Completing Form 990 can seem daunting, but with careful preparation, it can be done efficiently. Here are some key steps to follow:

01

Gather all necessary financial documents, including income statements, balance sheets, and expense records.

02

Review the instructions provided by the IRS for the specific type of Form 990 you need to file.

03

Enter accurate financial information into the appropriate sections of the form, ensuring all numbers are correctly calculated.

04

Provide detailed information about the organization's activities, governance, and compliance with tax laws.

05

Double-check all entries for accuracy and completeness before submitting the form.

06

Consider consulting with a tax professional or using online tools like pdfFiller to streamline the process and ensure compliance.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.