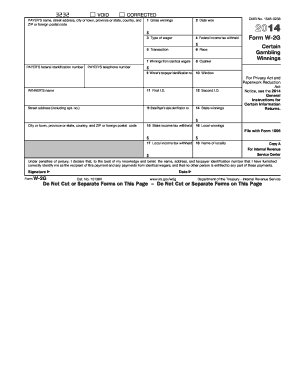

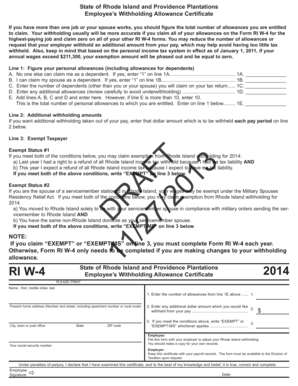

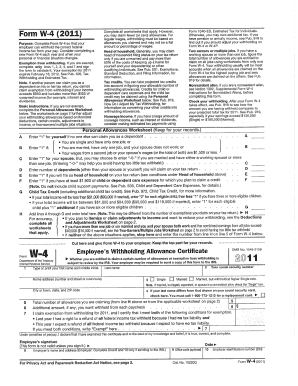

Form W-4 2014

What is form w-4 2014?

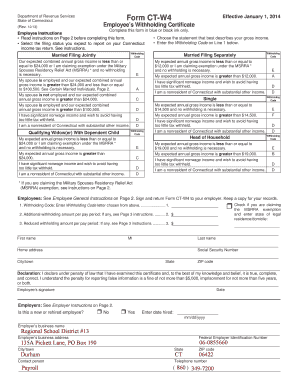

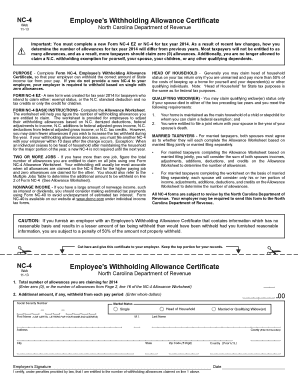

The Form W-4 2014 is an employee's withholding allowance certificate that is used to determine the amount of federal income tax to be withheld from an employee's paycheck. It is a crucial form for both employers and employees as it ensures accurate tax withholding throughout the year.

What are the types of form w-4 2014?

There are two types of Form W-4 2014: the Employee's Withholding Allowance Certificate and the Spanish version, Certificado de Exención de Retenciones del Empleado. The English version is used by most employees, while the Spanish version is for Spanish-speaking employees who are exempt from federal income tax withholding.

How to complete form w-4 2014

Completing Form W-4 2014 is a simple process. Here are the steps to follow:

pdfFiller is a powerful online platform that empowers users to easily create, edit, and share documents, including Form W-4 2014. With unlimited fillable templates and advanced editing tools, pdfFiller is the only PDF editor you'll need to complete your documents efficiently and accurately.