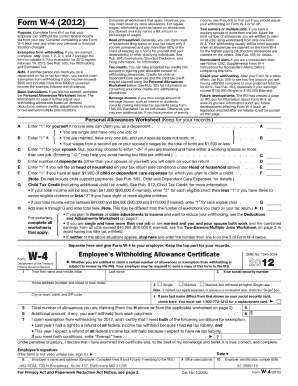

Form W 4 2017

What is form w 4 2017?

Form W-4 2017 is a tax form used by employees to inform their employers about the amount of federal income tax to withhold from their wages. By filling out this form accurately, employees can ensure that the correct amount of tax is withheld throughout the year.

What are the types of form w 4 2017?

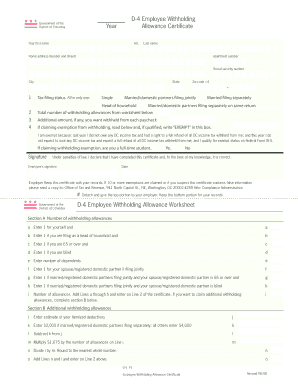

There are three types of Form W-4 2017: the Employee's Withholding Allowance Certificate, the Employer's Withholding Allowance Certificate, and the State Withholding Allowance Certificate. Each type serves a specific purpose, allowing employees, employers, and states to determine the correct withholding allowances and amounts.

How to complete form w 4 2017

Completing Form W-4 2017 is a straightforward process. Here is a step-by-step guide to help you:

pdfFiller is an online platform that empowers users to effortlessly create, edit, and share documents online. With a vast library of unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for all your document needs.