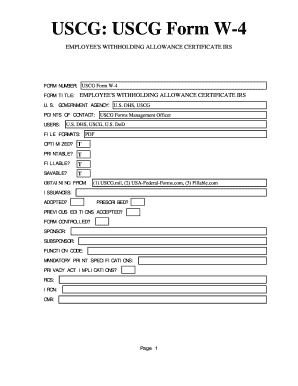

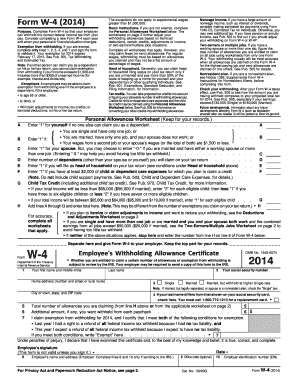

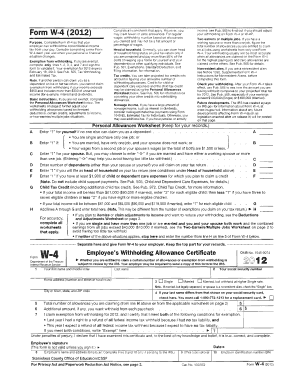

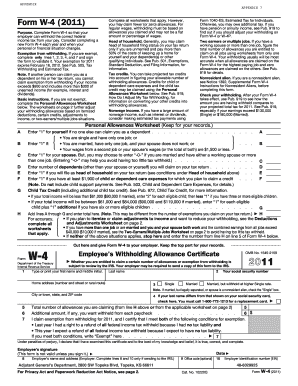

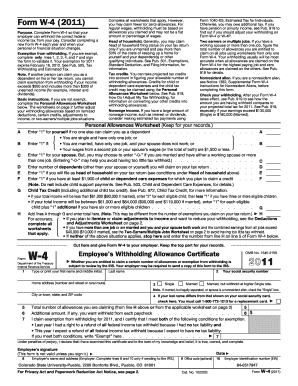

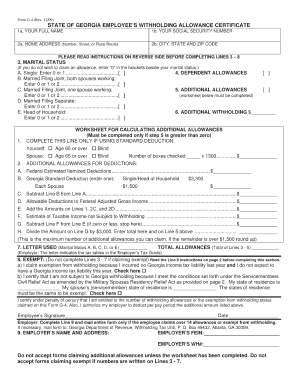

Form W-4

What is form w-4?

Form W-4 is an Employee's Withholding Certificate that is filled out by employees to inform their employers about the amount of federal income tax to withhold from their paychecks. It helps employers determine the correct amount of federal income tax to deduct from employees' wages.

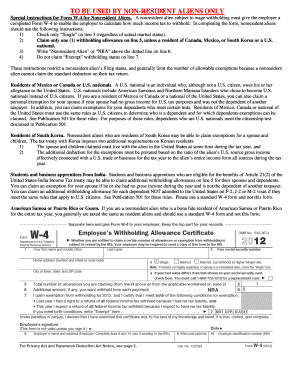

What are the types of form w-4?

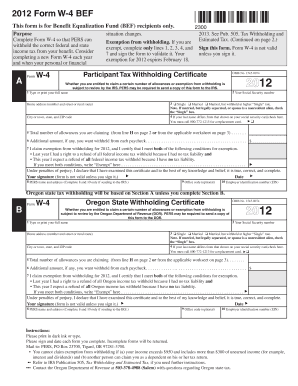

There are two main types of Form W-4: 1. Form W-4 for employees: This is the standard form that most employees fill out to provide their withholding information to their employers. 2. Form W-4P for pension recipients: This form is specifically designed for pension recipients who want to withhold federal income tax from their pension payments.

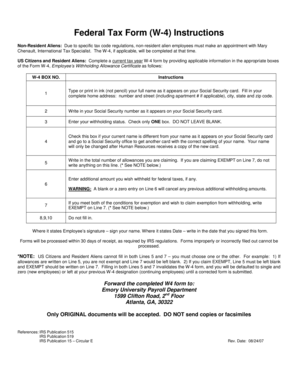

How to complete form w-4

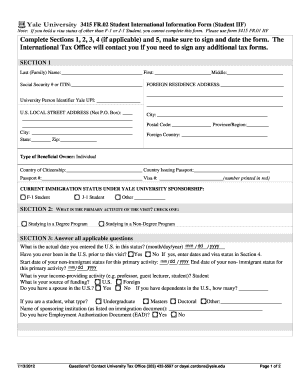

Completing Form W-4 is a simple process that requires the following steps: 1. Provide your personal information: Fill in your name, address, Social Security number, and filing status. 2. Declare multiple jobs or spouse's income: If you have more than one job or your spouse also works, you may need to complete the Multiple Jobs Worksheet or the Two-Earners/Multiple Jobs Worksheet to adjust your withholding. 3. Claim dependents: If you have dependents whom you want to claim for tax purposes, indicate the number of allowances you want to claim in the appropriate section. 4. Make additional adjustments: If you have other income, deductions, or extra withholding you want to include, follow the instructions on Form W-4 to make these adjustments. 5. Sign and date the form: Once you have completed the form, sign and date it to certify that the information provided is accurate. Remember to update your Form W-4 whenever your personal or financial situation changes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.