Full Reconveyance Letter

What is full reconveyance letter?

A full reconveyance letter is a document used in real estate transactions to release the property owner from a mortgage lien. It is sent by the lender to the borrower after the mortgage debt has been fully paid off. This letter acknowledges that the borrower has fulfilled their obligations and that the mortgage lien on the property is being removed.

What are the types of full reconveyance letter?

There are two main types of full reconveyance letters:

Voluntary Reconveyance: This type of letter is used when the borrower voluntarily pays off the mortgage in full and requests the reconveyance from the lender.

Foreclosure Reconveyance: This type of letter is issued by the lender when the property goes through a foreclosure process and the borrower's debt is satisfied.

It's important to note that the specific contents and requirements of a full reconveyance letter can vary depending on local laws and regulations.

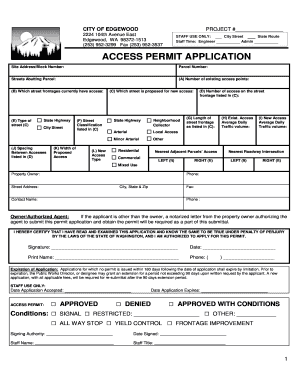

How to complete full reconveyance letter

Completing a full reconveyance letter involves the following steps:

01

Begin by addressing the letter to the appropriate party, typically the lender or the loan department.

02

Include the borrower's full name and contact information.

03

State the purpose of the letter, which is to request a full reconveyance of the property.

04

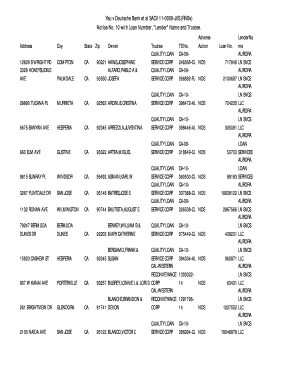

Provide details about the mortgage, such as the loan number, property address, and the original loan amount.

05

Mention that the mortgage debt has been fully paid off and that the borrower is requesting the removal of the mortgage lien.

06

Express gratitude and request confirmation of the reconveyance in writing.

07

Sign the letter and provide any necessary supporting documents.

08

Keep a copy of the letter for your records and send it via certified mail or other trackable method.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out full reconveyance letter

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you read a substitution of trustee and full reconveyance?

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien. Most importantly, a deed of full reconveyance, known as a satisfaction of mortgage in some states, transfers title back to the borrower.

What is the purpose of a reconveyance?

A deed of reconveyance indicates that you've fully paid off your mortgage on your home, representing the transfer of ownership from your mortgage lender to you. Over the time you repaid your mortgage, you legally owned the property, but the lender held the mortgage lien, or claim, to it.

Is a full reconveyance the same as a deed?

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been paid in full and the lender no longer has an interest in your property.

What is a full reconveyance letter?

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

Why did I receive a full reconveyance letter?

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been paid in full and the lender no longer has an interest in your property. With your mortgage or deed of trust paid off, you cannot be foreclosed on by a financial institution.

What is a substitution of trustee and full reconveyance in California?

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender. In most cases, the document shows that a loan has been paid off. Property owners may even receive this document if they have refinanced a loan.

Related templates