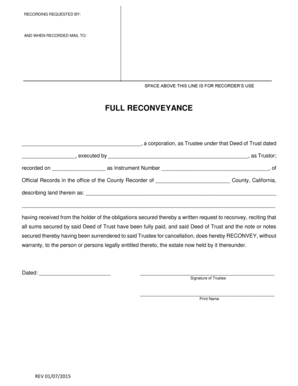

Full Reconveyance Of Deed Of Trust

What is full reconveyance of deed of trust?

Full reconveyance of deed of trust refers to the legal process by which a lender releases the lien on a property once the borrower has fully repaid the loan. It is a document that proves the borrower's debt has been satisfied and the lender no longer has a claim on the property.

What are the types of full reconveyance of deed of trust?

There are two types of full reconveyance of deed of trust:

Voluntary reconveyance: This occurs when the borrower pays off the loan voluntarily and requests the lender to release the lien on the property.

Involuntary reconveyance: This happens when the borrower defaults on the loan and the lender initiates the foreclosure process. Once the property is sold at a foreclosure sale, the lender releases the lien through an involuntary reconveyance.

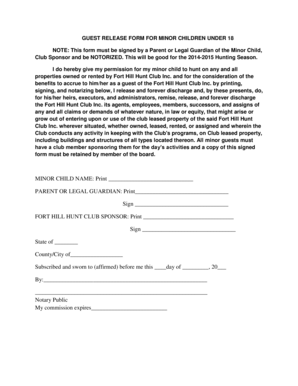

How to complete full reconveyance of deed of trust

Completing a full reconveyance of deed of trust involves the following steps:

01

Verify that the loan has been fully repaid by the borrower.

02

Prepare the necessary reconveyance documents, including a reconveyance deed or a satisfaction of mortgage document.

03

Have the borrower sign the reconveyance document in the presence of a notary public.

04

Record the reconveyance document with the county recorder's office to ensure it becomes a part of the official property records.

05

Notify the borrower and any other parties with an interest in the property that the reconveyance has been completed.

06

Finally, update the relevant credit reporting agencies to reflect the full repayment of the loan.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out full reconveyance of deed of trust

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What does reconveyance mean in mortgage?

In that context, reconveyance refers to the transfer of title to real estate from a creditor to the debtor when a loan secured by the property—i.e. mostly likely a mortgage with the property as collateral—is paid off.

How do I remove a deed of trust in California?

A deed of trust is a legal document that gives your mortgage lender a lien on your home. The lien attaches to your property for as long as you still owe money under the mortgage loan. California state law requires a mortgage lender to remove the deed of trust within 21 days after you fully pay off the mortgage loan.

Is a full reconveyance the same as a deed of trust?

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been paid in full and the lender no longer has an interest in your property. With your mortgage or deed of trust paid off, you cannot be foreclosed on by a financial institution.

What does a substitution of trustee and full reconveyance mean?

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien. Most importantly, a deed of full reconveyance, known as a satisfaction of mortgage in some states, transfers title back to the borrower.

Why did I receive a full reconveyance letter?

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been paid in full and the lender no longer has an interest in your property. With your mortgage or deed of trust paid off, you cannot be foreclosed on by a financial institution.

What is the purpose of a substitution of trustee and full reconveyance?

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien. Most importantly, a deed of full reconveyance, known as a satisfaction of mortgage in some states, transfers title back to the borrower.

Related templates