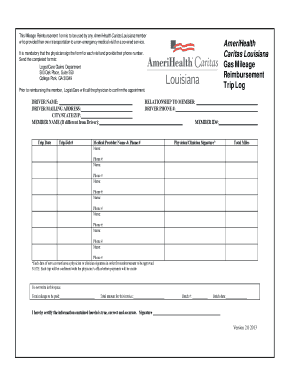

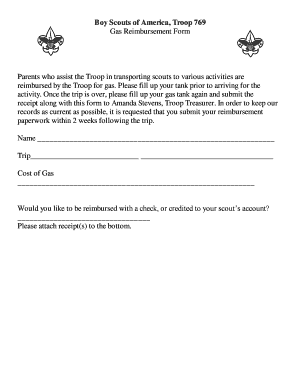

Gas Reimbursement Form

What is Gas Reimbursement Form?

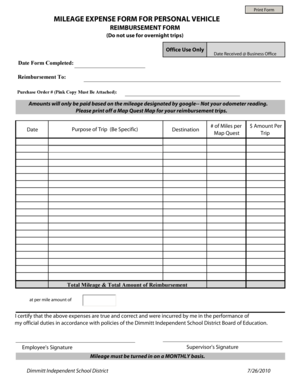

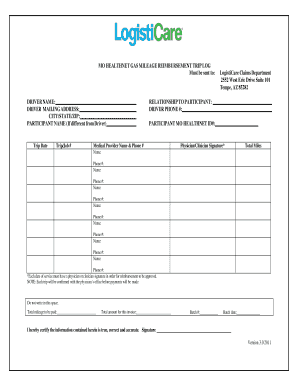

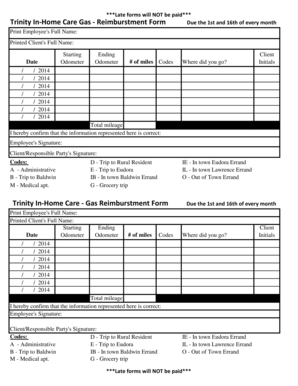

A Gas Reimbursement Form is a document that allows individuals to request reimbursement for expenses incurred while using their personal vehicle for business-related purposes. It serves as a record of the expenses and ensures that employees are compensated for the fuel costs they have incurred.

What are the types of Gas Reimbursement Form?

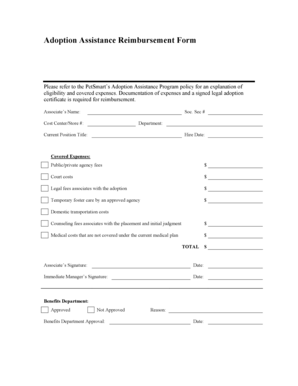

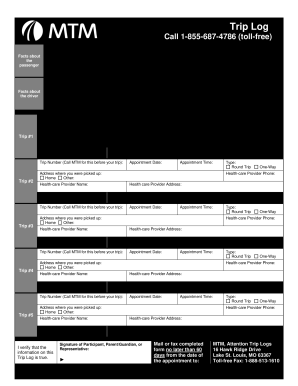

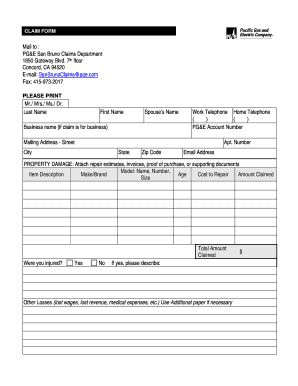

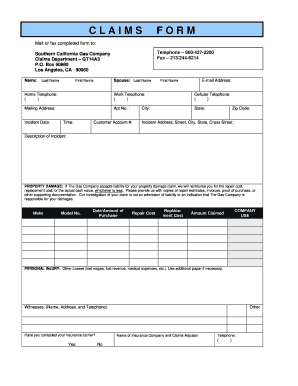

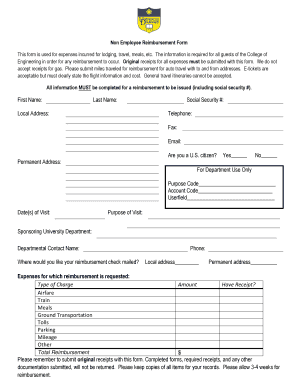

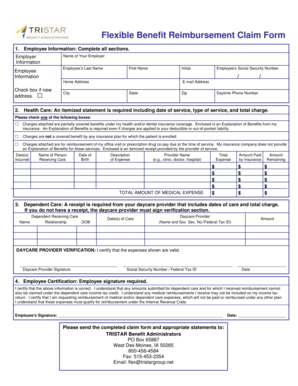

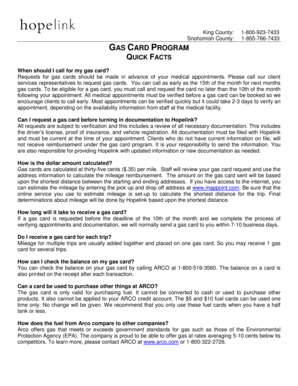

There are several types of Gas Reimbursement Forms available, depending on the specific requirements of the company or organization. Some common types include: 1. Standard Gas Reimbursement Form: This form is used for regular business-related travel and requires employees to provide details such as the date, purpose of the trip, starting and ending locations, and the number of miles traveled. 2. Specialized Gas Reimbursement Form: This form is used for specific types of travel, such as long-distance trips or overnight stays. It may require additional information such as hotel receipts or meal expenses. 3. Monthly Gas Reimbursement Form: This form is used to consolidate all gas expenses for a month. It allows employees to submit a single form instead of multiple forms for each individual trip.

How to complete Gas Reimbursement Form

Completing a Gas Reimbursement Form is a simple process. Follow the steps below to ensure accuracy and prompt reimbursement: 1. Obtain a copy of the Gas Reimbursement Form from your company's HR department or download it from the company's intranet. 2. Fill in the required fields with the necessary information, such as the date of the trip, purpose of the trip, starting and ending locations, and the number of miles traveled. 3. Attach any supporting documents, such as fuel receipts or toll invoices, to substantiate your claims. 4. Double-check the form for any errors or missing information. 5. Sign the form and submit it to the appropriate department for processing. By following these steps, you can ensure that your Gas Reimbursement Form is completed accurately and efficiently.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.