What is hold harmless agreement insurance company?

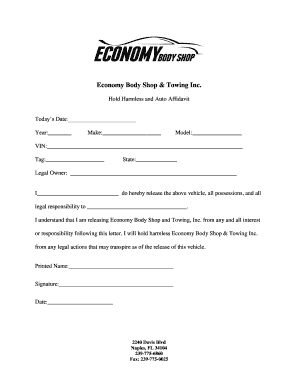

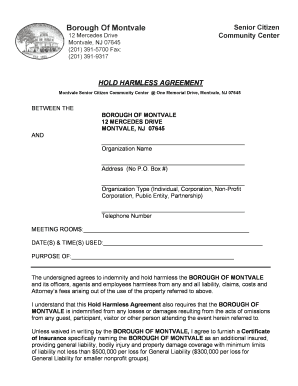

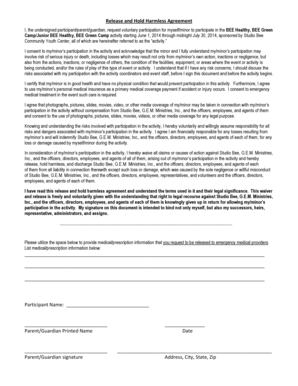

A hold harmless agreement insurance company is a contractual provision in which one party agrees to indemnify and protect another party from any potential legal claims or damages. This type of agreement is commonly used in the insurance industry to transfer risks and protect both parties involved. The insurance company assumes the responsibility for any loss or harm that may occur, relieving the other party from any liability.

What are the types of hold harmless agreement insurance company?

There are different types of hold harmless agreement insurance company that cater to specific situations and needs. Some common types include:

Broad Form Hold Harmless Agreement: This type of agreement provides protection to the indemnitee for all claims arising from the work or services provided by the indemnitor. It covers a wide range of potential liabilities.

Intermediate Form Hold Harmless Agreement: This agreement offers limited protection to the indemnitee by excluding certain types of claims from the indemnitor's responsibility. The specific scope of coverage is defined in the agreement.

Limited Form Hold Harmless Agreement: This type of agreement restricts the indemnification to only certain claims or damages as specified in the contract. It provides a more limited level of protection.

Comparative Form Hold Harmless Agreement: With this agreement, the responsibility for claims or damages is shared between the parties based on their respective degrees of negligence or fault. It allows for a fairer allocation of liability.

Specific Form Hold Harmless Agreement: This agreement focuses on a particular risk or scenario, providing protection against specific claims or damages outlined in the contract. It is often used for more specialized situations.

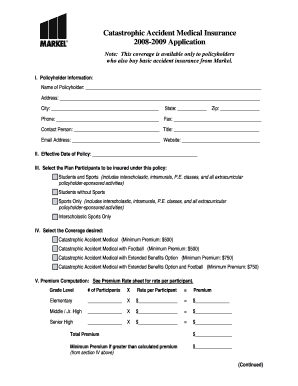

How to complete hold harmless agreement insurance company

Completing a hold harmless agreement with an insurance company requires attention to detail and understanding of the terms involved. Here are the steps to follow:

01

Identify the parties involved: Clearly state the names and roles of the indemnitor (the party providing the indemnification) and the indemnitee (the party being protected).

02

Specify the scope of coverage: Define the types of claims or damages that the indemnitor will assume responsibility for, ensuring clarity and specificity.

03

Establish the duration of the agreement: Determine the start and end dates of the hold harmless agreement to clarify the period of coverage.

04

Include any additional provisions: Depending on the specific needs of the situation, additional provisions such as insurance requirements or dispute resolution methods may be included.

05

Review and sign the agreement: Carefully review the terms and conditions, making sure all parties understand and agree to them. Sign the agreement to make it legally binding.

pdfFiller is an online platform that empowers users to create, edit, and share documents effortlessly. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for users looking to efficiently manage their documents. Whether you need to complete a hold harmless agreement or any other type of document, pdfFiller provides the tools and features necessary to get the job done.