How To Write A Loan Agreement

What is how to write a loan agreement?

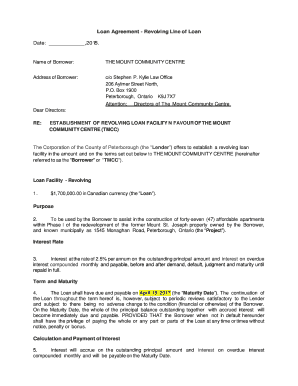

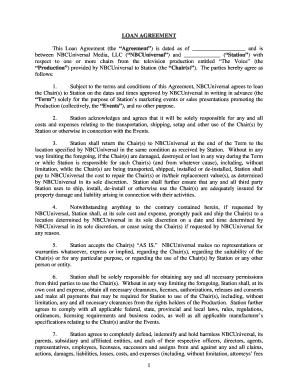

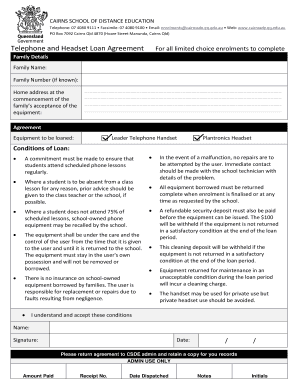

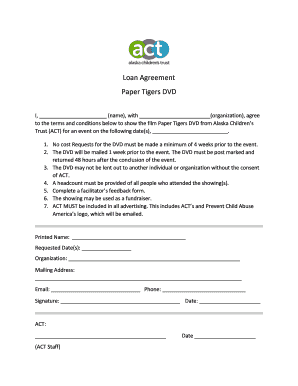

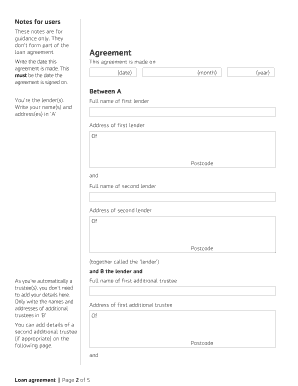

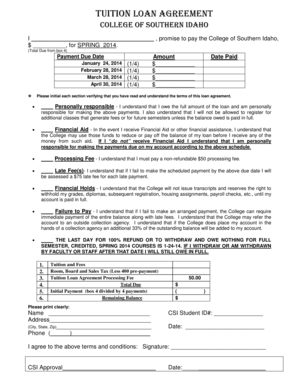

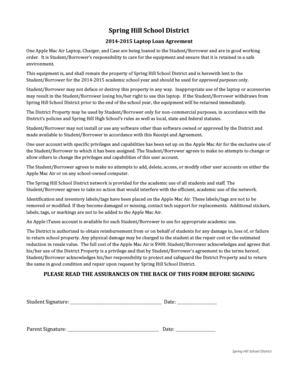

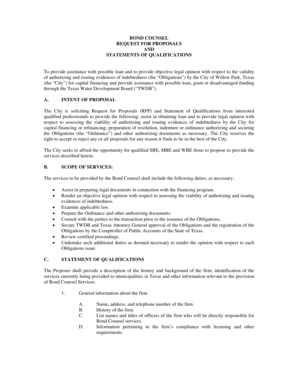

When it comes to writing a loan agreement, it is important to understand the key components and terminology involved. A loan agreement is a legally binding contract between a lender and a borrower that outlines the terms and conditions of a loan. It establishes the rights and obligations of both parties and provides clarity on factors such as the loan amount, interest rate, repayment schedule, and any applicable fees or penalties. By following a structured approach and using a reliable online platform like pdfFiller, you can easily create a comprehensive loan agreement to protect both parties involved.

What are the types of how to write a loan agreement?

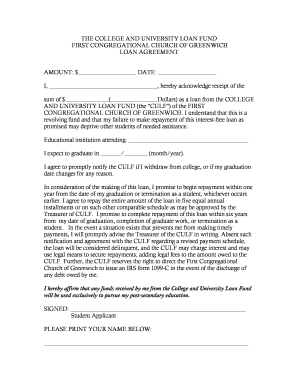

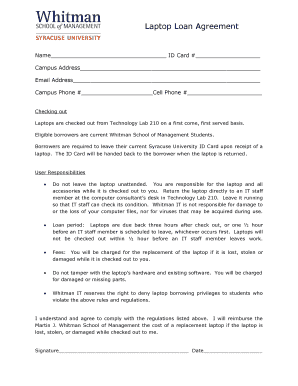

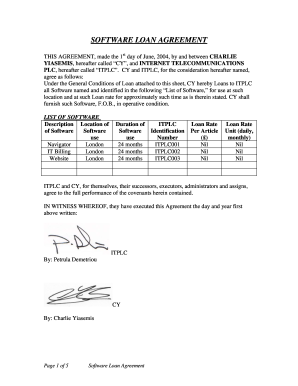

There are various types of loan agreements that can be customized to meet specific needs. Some common types include: 1. Personal Loan Agreement: This agreement is typically used for loans between individuals, such as friends or family members. 2. Business Loan Agreement: This type of agreement is designed for loans between a business entity and a lender, outlining the terms and conditions of the loan. 3. Mortgage Loan Agreement: Specifically used for mortgage loans, this agreement establishes the terms of borrowing money to purchase a property, including details such as the property's value and mortgage interest rate. 4. Student Loan Agreement: This agreement is used for educational loans and includes provisions for repayment and any deferment options. Using pdfFiller's extensive library of fillable templates, you can easily select the appropriate loan agreement type and customize it to meet your specific requirements.

How to complete how to write a loan agreement?

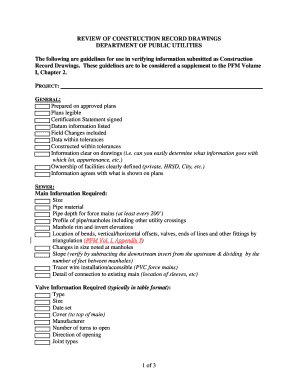

Completing a loan agreement involves several key steps: 1. Gather necessary information: Collect all relevant details such as the loan amount, repayment terms, interest rate, and any additional conditions or clauses. 2. Select a loan agreement template: Choose an appropriate loan agreement template from pdfFiller's vast collection of options, ensuring it aligns with the type of loan agreement you need. 3. Customize the template: Fill in the required fields of the template, including names of the parties involved, loan terms, and any specific provisions. Modify the template as needed to tailor it to your unique situation. 4. Review and edit: Carefully review the completed loan agreement for accuracy and clarity. Make any necessary edits or revisions to ensure it accurately reflects the intended terms. 5. Share and sign: Share the loan agreement with all parties involved for review and signature. Utilize pdfFiller's convenient sharing options to streamline the process, ensuring all parties have access to the document and can sign electronically. By following these steps and utilizing pdfFiller's user-friendly platform, you can effortlessly complete a comprehensive loan agreement that meets all legal requirements.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.