What is 1040 Tax Table Form?

The 1040 Tax Table Form, also known as Form 1040, is the official document provided by the Internal Revenue Service (IRS) in the United States for individuals to report their annual income and calculate their federal income tax. It serves as a tool to determine the amount of tax owed or the refund due to the taxpayer.

What are the types of 1040 Tax Table Form?

The IRS offers different versions of Form 1040 to cater to various situations and levels of income. Here are some common types:

The standard Form 1040, used by most taxpayers who have taxable income and deductions to report.

1040A: A simplified version of Form 1040 for taxpayers with less complex financial situations and limited deductions.

1040EZ: The shortest and simplest version of Form 1040, designed for taxpayers with very straightforward tax situations and no dependents or itemized deductions.

How to complete 1040 Tax Table Form

Completing the 1040 Tax Table Form may seem daunting at first, but it can be broken down into simple steps. Here's a step-by-step guide to help you out:

01

Gather all necessary financial documents such as W-2 forms, 1099 forms, and any other income reports.

02

Fill out the personal information section accurately, including your name, Social Security number, and filing status.

03

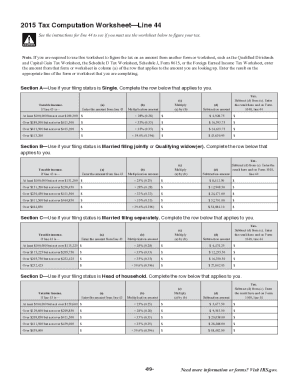

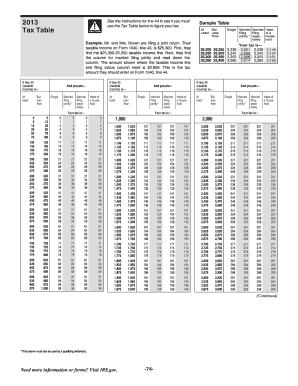

Report your income in the appropriate sections, ensuring you include all taxable income from various sources.

04

Calculate your deductions and credits, making sure to use the appropriate forms or schedules as needed.

05

Carefully review your completed form for accuracy, ensuring all calculations are correct and all necessary attachments are included.

06

Sign and date the form before submitting it to the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.