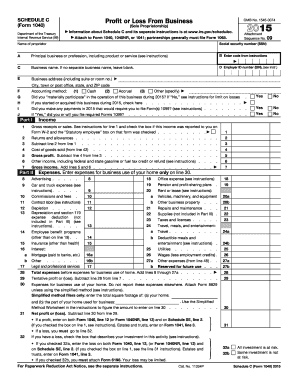

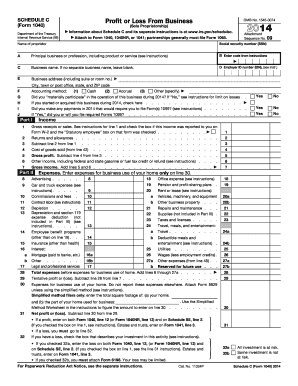

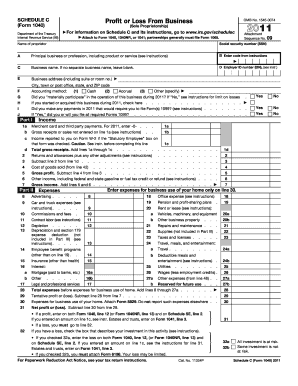

Schedule C (1040 Form)

What is Schedule C (1040 Form)?

Schedule C is a form used by self-employed individuals to report their business income and expenses on their personal tax return. It is a crucial component of the 1040 Form, which is the standard individual income tax return form in the United States. By filling out Schedule C, self-employed individuals can calculate their net profit or loss from their business activities.

What are the types of Schedule C (1040 Form)?

There are several types of Schedule C forms that cater to different types of businesses. The most commonly used types of Schedule C include: 1. Sole Proprietorship: This is the most basic form of business ownership, where the individual is the sole owner and has complete control over operations and profits. 2. Single-Member LLC: A Limited Liability Company (LLC) with only one member, who is considered a sole proprietor for tax purposes. 3. Partnership: When two or more individuals share ownership and the responsibility of running a business together. 4. S Corporation: This type of business structure allows for pass-through taxation, where profits and losses are reported on individual tax returns.

How to complete Schedule C (1040 Form)

Completing Schedule C requires gathering and organizing all relevant business income and expense records. Here is a step-by-step guide to help you complete Schedule C:

With pdfFiller, completing Schedule C (1040 Form) has never been easier. Empowering users to create, edit, and share documents online, pdfFiller offers unlimited fillable templates and powerful editing tools. It is the ultimate PDF editor that allows you to efficiently complete your tax forms and other documents.