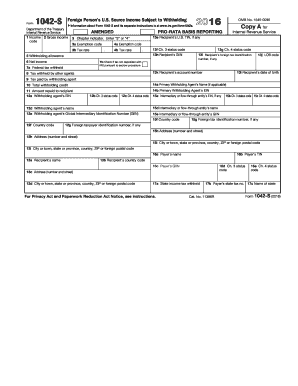

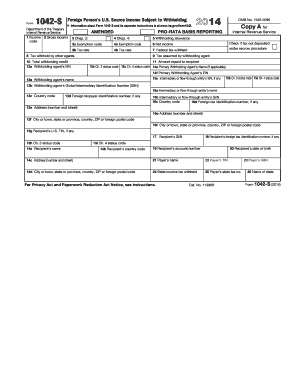

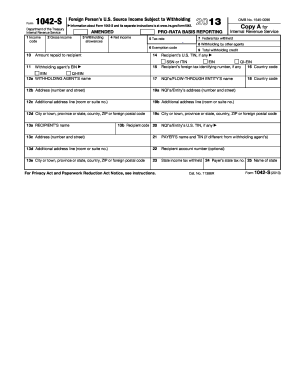

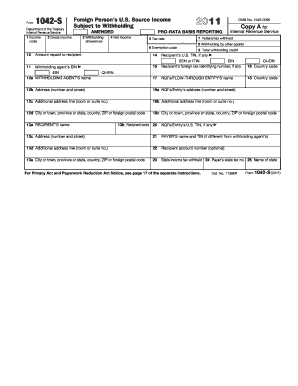

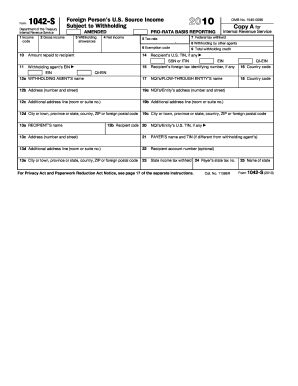

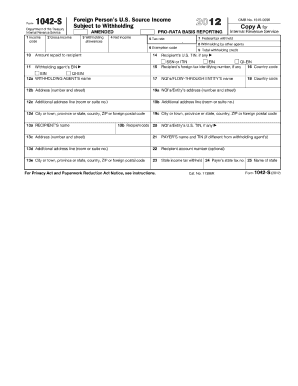

1042-S Form

What is 1042-S Form?

The 1042-S Form is a tax form used by foreign individuals and entities to report income received from U.S. sources. It is also used by withholding agents to report the amount of tax withheld on behalf of the foreign individuals or entities. The form is submitted to the Internal Revenue Service (IRS) to ensure compliance with U.S. tax laws.

What are the types of 1042-S Form?

There are several types of 1042-S Form, depending on the nature of the income being reported. The most common types include:

How to complete 1042-S Form

Completing the 1042-S Form requires attention to detail and accuracy. Here are the steps to complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.