Irs 2290 Phone Number

What is irs 2290 phone number?

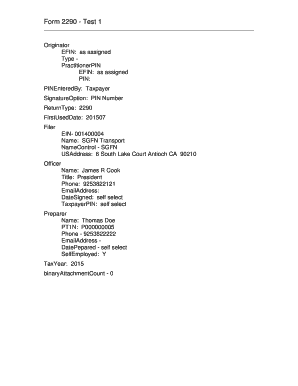

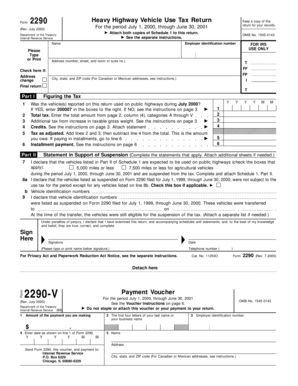

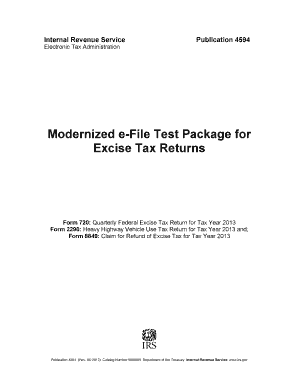

The IRS 2290 phone number is a contact number provided by the Internal Revenue Service (IRS) for any inquiries related to the Form 2290. Form 2290 is used by individuals or businesses to report and pay the heavy vehicle use tax to the IRS. The phone number serves as a direct line of communication between taxpayers and the IRS to seek guidance, ask questions, or address any concerns regarding their Form 2290 filing.

What are the types of irs 2290 phone number?

The IRS provides two main types of phone numbers for individuals calling about their Form 2290: 1. General Inquiries and Assistance: This phone number is for taxpayers who have general questions or need assistance regarding their Form 2290 filing. The IRS representatives can provide guidance on various aspects related to Form 2290, such as filing requirements, payment options, deadlines, and any other queries related to heavy vehicle use tax. 2. Payment and Account-Related Inquiries: This phone number is specifically designated for taxpayers who require assistance or have questions related to payments, account balances, penalties, or other issues related to their Form 2290 tax payment.

How to complete irs 2290 phone number

Completing the IRS 2290 phone number is a relatively straightforward process. Just follow these steps: 1. Determine the purpose of your call: Are you calling for general inquiries or specific account-related questions? This will help you choose the correct phone number to contact the IRS.

Remember, for a hassle-free experience in completing your Form 2290 and other documents, you can rely on pdfFiller. With a wide range of features and tools, pdfFiller empowers users to easily create, edit, and share documents online. Whether you need fillable templates or robust editing capabilities, pdfFiller is your go-to PDF editor.