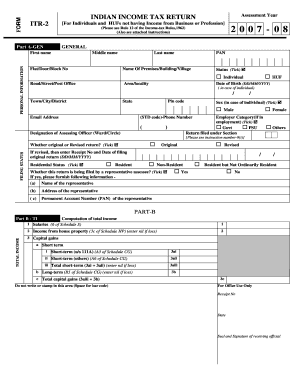

What is ITR Form?

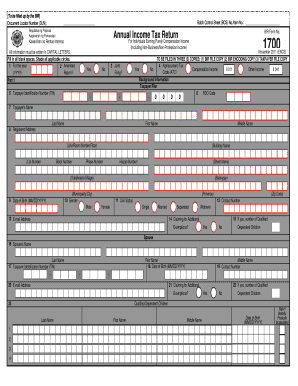

An ITR form, or Income Tax Return form, is a document that individuals and businesses use to file their income tax returns with the tax authorities. It is important to accurately fill out the ITR form to comply with tax regulations and avoid penalties.

What are the types of ITR Form?

The types of ITR forms vary based on the source and amount of income, as well as the residential status of the taxpayer. Here are some common types of ITR forms:

ITR-For individuals with income from salary, one house property, other sources, and total income up to INR 50 lakhs.

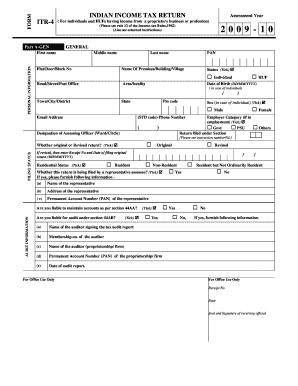

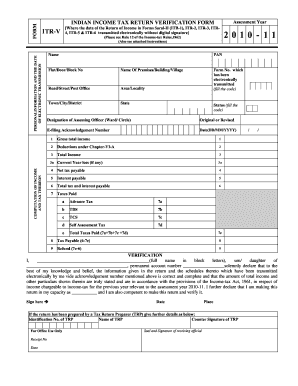

ITR-For individuals and Hindu Undivided Families (HUF) having income from sources other than income from business or profession.

ITR-For individuals and HUFs having income from a proprietary business or profession.

ITR-For individuals, HUFs, and firms (other than Limited Liability Partnership) having presumptive income from business or profession.

ITR-For persons other than individuals, HUFs, companies, and persons filing Form ITR-7.

ITR-For companies other than those claiming exemption under section 11 (Income from property held for charitable or religious purposes) of the Income Tax Act, 1961.

ITR-For persons including companies, required to furnish return under sections 139(4A), 139(4B), 139(4C), 139(4D), or 139(4E) of the Income Tax Act, 1961.

How to complete ITR Form

Completing the ITR form can be a bit overwhelming, but with these steps, you can easily file your income tax return:

01

Gather all necessary documents like PAN card, Form-16, bank statements, etc.

02

Select the appropriate ITR form based on your income sources and residential status.

03

Carefully fill out all the sections of the ITR form, ensuring accuracy and completeness.

04

Double-check all the entered information before submitting the form.

05

If required, attach the supporting documents along with the ITR form.

06

Submit the completed ITR form either electronically or by physically mailing it to the tax authorities.

07

Keep a copy of the submitted ITR form for future reference.

pdfFiller is a versatile platform that enables users to easily create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that users can rely on to streamline their document workflow and get their documents done efficiently.