Job Description Accountant

What is job description accountant?

A job description for an accountant provides a detailed overview of the responsibilities, duties, and qualifications required for the role. It outlines the specific tasks that an accountant is expected to perform, such as maintaining financial records, preparing financial statements, and analyzing financial data. The job description also includes information about the necessary skills, qualifications, and experience needed to succeed in the position. By providing a clear job description, employers can attract qualified candidates and ensure that potential employees have a clear understanding of the role.

What are the types of job description accountant?

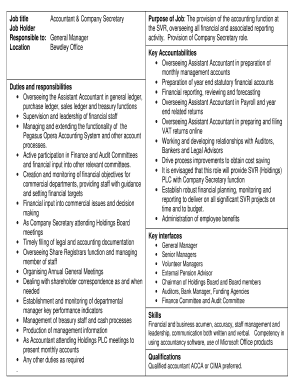

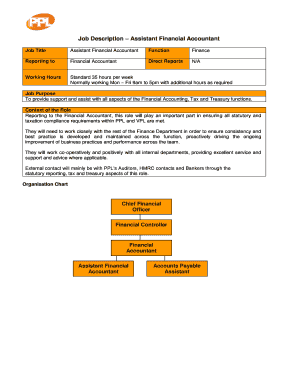

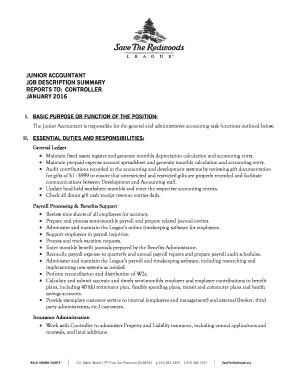

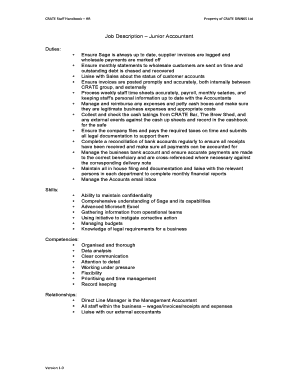

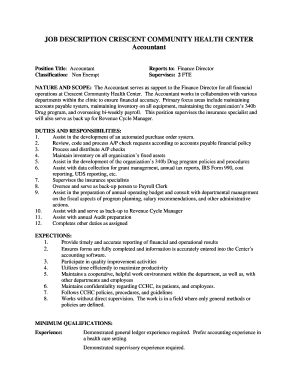

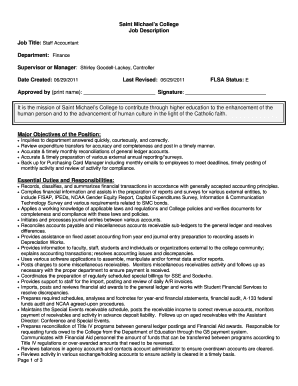

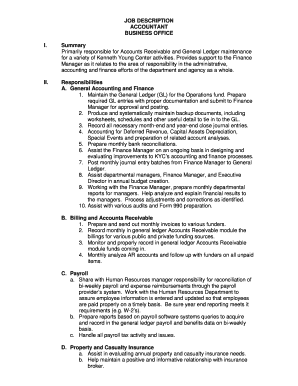

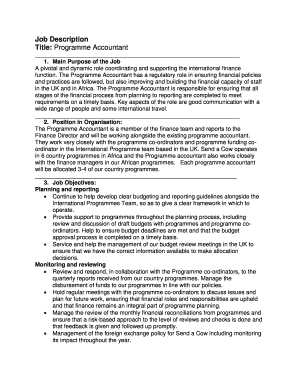

There are several types of job descriptions for accountants, each tailored to specific roles within the field. Some common types include:

How to complete job description accountant

Completing a job description for an accountant requires careful consideration of the specific requirements of the position. Here are some steps to help you create an effective job description:

By following these steps, you can create a comprehensive and informative job description that will attract qualified accountants to your organization.