What is a land contract agreement?

A land contract agreement is a legally binding contract between a buyer and a seller for the purchase of a property. It is an alternative to traditional mortgage financing, where the buyer pays the seller directly over a specified period of time.

What are the types of land contract agreements?

There are two main types of land contract agreements: 1. Installment Land Contract: In this type, the buyer makes regular payments to the seller, typically monthly, until the full purchase price is paid. 2. Lease Option Agreement: This type allows the buyer to lease the property for a specified period with the option to purchase it at the end of the lease term.

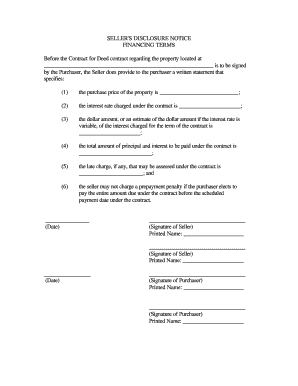

How to complete a land contract agreement

Completing a land contract agreement involves the following steps: 1. Negotiate the terms: Discuss and agree upon the purchase price, payment schedule, interest rate (if any), and other important terms with the seller. 2. Draft the agreement: Create a written contract that includes all the agreed-upon terms and conditions. 3. Review and revise: Carefully review the contract and make any necessary revisions or additions. 4. Sign the agreement: Both the buyer and the seller should sign the contract to make it legally binding. 5. Record the agreement: It is important to record the land contract agreement with the appropriate government office to establish the buyer's legal interest in the property.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.