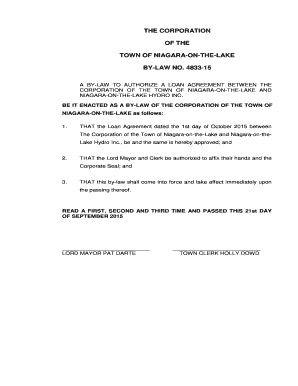

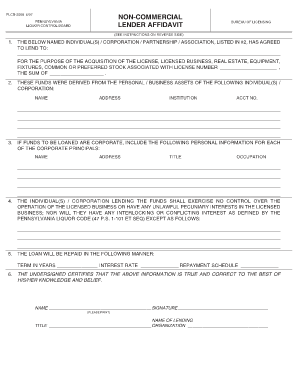

What is loan agreement corporation to individual?

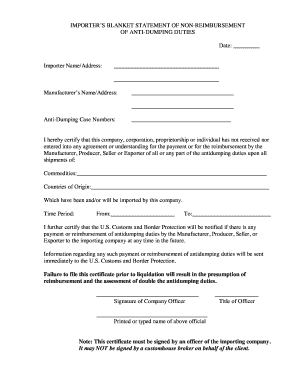

A loan agreement corporation to individual is a legally binding document that outlines the terms and conditions of a loan between a corporation or company and an individual. It is a formal agreement that specifies the amount of money being borrowed, the interest rate, repayment terms, and any other relevant details. This type of loan agreement is commonly used for business purposes, such as financing equipment or funding a project.

What are the types of loan agreement corporation to individual?

There are various types of loan agreements between a corporation and an individual. Some common types include:

Term Loans: These are loans with a fixed repayment period and interest rate. They are often used for large purchases or long-term financing.

Line of Credit: This type of loan provides the borrower with a predetermined credit limit. The borrower can withdraw funds as needed and only pays interest on the amount borrowed.

Secured Loans: These loans are backed by collateral, such as property or assets. If the borrower fails to repay the loan, the corporation can seize the collateral.

Unsecured Loans: These loans do not require collateral. They are based solely on the borrower's creditworthiness and ability to repay.

Convertible Loans: This type of loan allows the corporation to convert the debt into equity in the future, usually through the issuance of shares.

How to complete loan agreement corporation to individual?

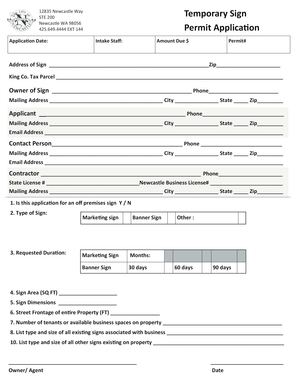

Completing a loan agreement corporation to individual involves several steps to ensure the agreement is valid and comprehensive. Here is a step-by-step guide:

01

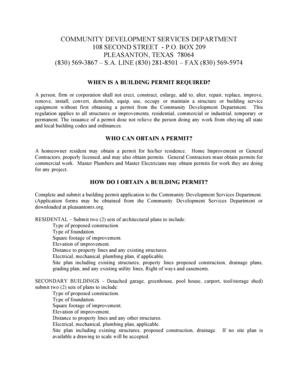

Gather all necessary information: Collect all the relevant details about the loan, including the loan amount, interest rate, repayment terms, and any additional conditions.

02

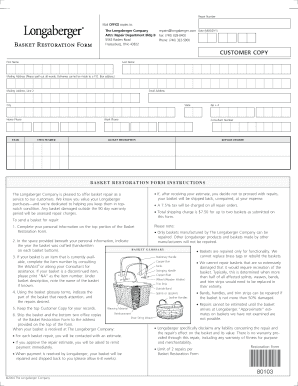

Review and customize a loan agreement template: Use a template or document creation tool like pdfFiller to create a loan agreement. Customize the template to include all the specific terms and conditions of the loan.

03

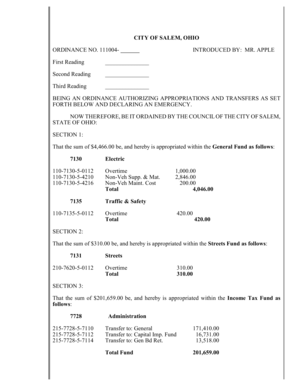

Include all necessary clauses: Make sure the loan agreement includes clauses for late payment penalties, default consequences, and any other relevant provisions.

04

Review and revise the agreement: Carefully review the loan agreement to ensure accuracy and clarity. Make any necessary revisions or corrections.

05

Obtain signatures: Once the loan agreement is finalized, have both the corporation and the individual sign the document to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.