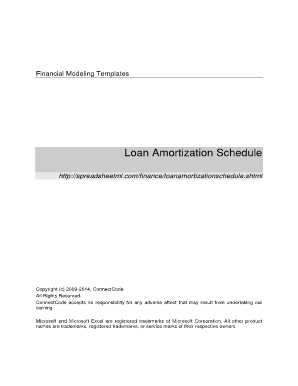

Loan Amortization Excel - Page 2

What is Loan Amortization Excel?

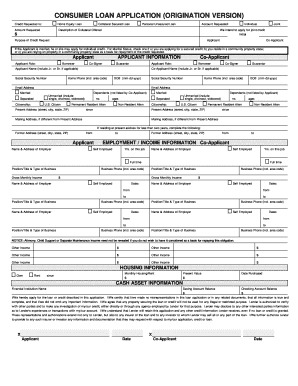

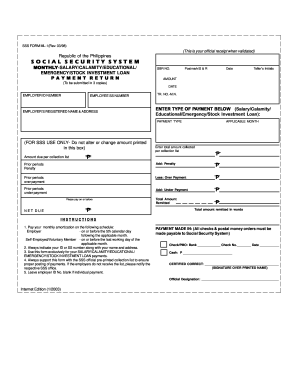

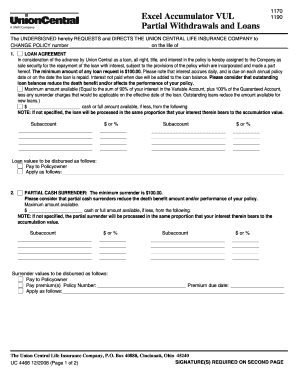

Loan Amortization Excel is a financial tool used to calculate and track the repayment of a loan over time. It uses an amortization schedule to show the breakdown of each payment, including the principal amount, interest, and remaining balance. This spreadsheet-based tool is commonly used by individuals, businesses, and financial institutions to analyze and plan loan payments.

What are the types of Loan Amortization Excel?

There are several types of Loan Amortization Excel templates available. Some common types include: 1. Simple Amortization: This type calculates the loan schedule based on fixed payments and a fixed interest rate. 2. Balloon Amortization: In this type, the loan payments are lower initially, but a larger final payment (balloon payment) is required. 3. Interest-Only Amortization: This type allows for interest-only payments for a certain period before full principal and interest payments begin. 4. Negative Amortization: This type allows for the loan balance to increase over time due to unpaid interest.

How to complete Loan Amortization Excel

Completing a Loan Amortization Excel template involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.