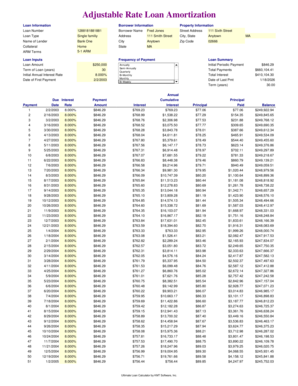

Loan Amortization Formula

What is loan amortization formula?

The loan amortization formula is a mathematical equation used to calculate the periodic payment amount of a loan, as well as the allocation of each payment towards principal and interest. It takes into account the loan amount, interest rate, and loan term to determine the repayment schedule.

What are the types of loan amortization formula?

There are two main types of loan amortization formulas: fixed-rate and adjustable-rate. 1. Fixed-rate amortization formula: This type of formula is commonly used for mortgages and personal loans. It calculates the equal monthly payments throughout the loan term, with a fixed interest rate. 2. Adjustable-rate amortization formula: This formula is often used for adjustable-rate mortgages. The interest rate can fluctuate over time, resulting in changes to monthly payment amounts.

How to complete loan amortization formula

Completing the loan amortization formula involves the following steps: 1. Determine the loan amount, interest rate, and loan term. 2. Insert the values into the loan amortization formula. 3. Calculate the periodic payment amount, which includes both principal and interest. 4. Create a repayment schedule that shows the allocation of each payment towards principal and interest. 5. Review and adjust the formula if necessary, based on any additional factors such as prepayments or changes in interest rate.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.