Loan Terms And Conditions Template

Terms and conditions can assist you with many different aspects of running your company. They allow you to prevent possible legal disputes, save your time, and improve your company’s reputation. With a simple online form, it is easy to make this type of agreement for your customers. pdfFiller offers editable Loan Terms And Conditions samples with industry-specific provisions to make sure your business has the proper legal protection. Choose the template that best suits your business needs and fill it out in our convenient PDF editor.

What is Loan Terms And Conditions Template?

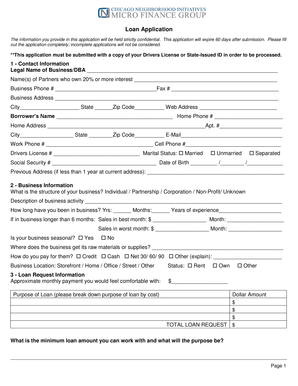

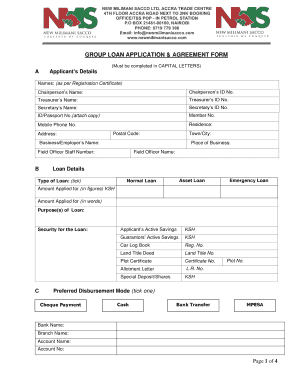

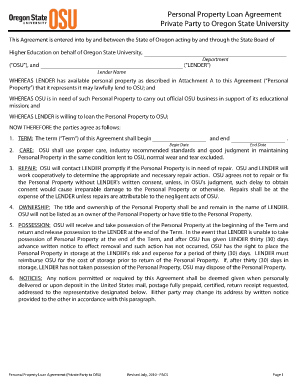

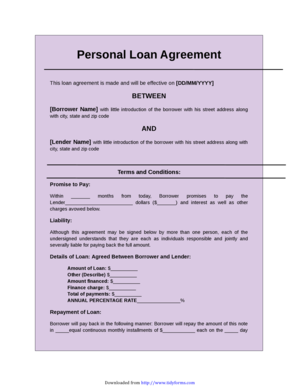

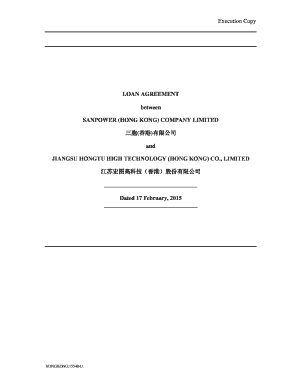

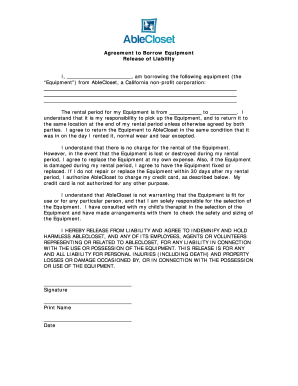

A Loan Terms And Conditions Template is a document that outlines the specific terms and conditions that govern a loan agreement between a lender and a borrower. It details the rights and responsibilities of both parties and clarifies the terms of the loan, including interest rates, repayment schedule, and any collateral required.

What are the types of Loan Terms And Conditions Template?

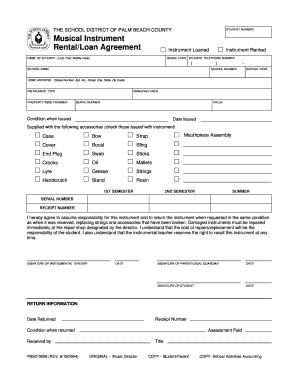

There are various types of Loan Terms And Conditions Templates available, each designed to suit different types of loans and borrower profiles. Some common types include:

How to complete Loan Terms And Conditions Template

Completing a Loan Terms And Conditions Template is a straightforward process that involves filling in the necessary information and ensuring both parties agree to the terms. Here are some steps to help you complete the template:

pdfFiller empowers users to create, edit, and share Loan Terms And Conditions Templates online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your loan documents done.