What is Mileage Reimbursement Spreadsheet?

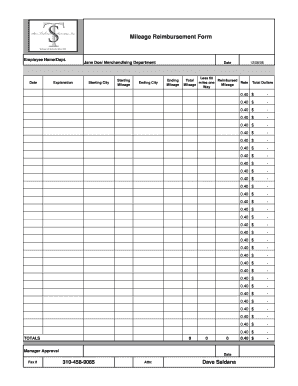

A Mileage Reimbursement Spreadsheet is a tool used to track and calculate the amount of reimbursement for mileage expenses. It is a spreadsheet that helps individuals or businesses keep track of the distance traveled for business purposes and the corresponding reimbursement amount. By using a mileage reimbursement spreadsheet, users can easily calculate the total mileage and reimbursement for a specific period, making the reimbursement process more organized and efficient.

What are the types of Mileage Reimbursement Spreadsheet?

There are several types of Mileage Reimbursement Spreadsheets available, depending on the specific needs and preferences of the users. Some common types include:

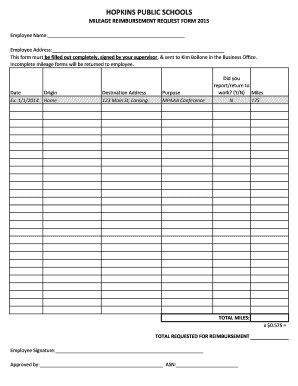

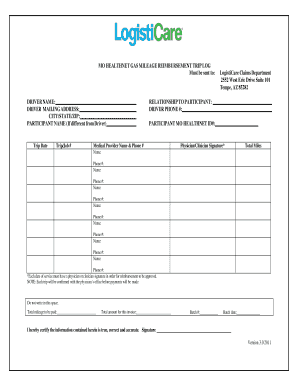

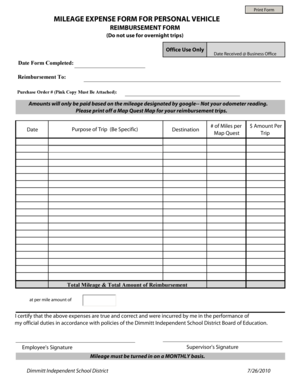

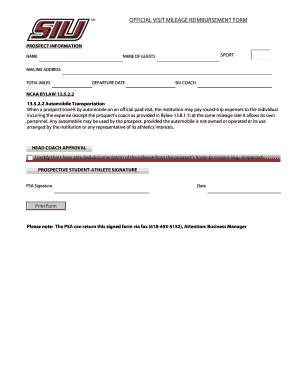

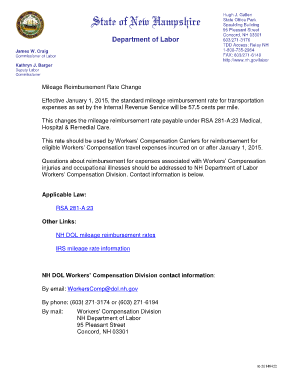

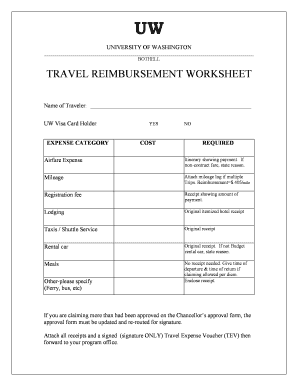

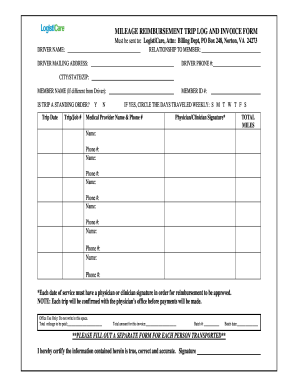

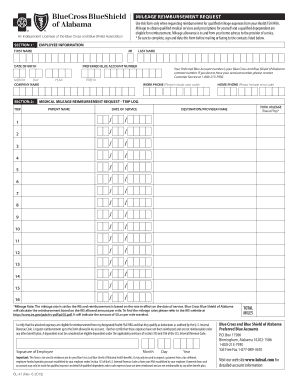

Basic Mileage Reimbursement Spreadsheet: This type includes essential fields such as date, starting location, destination, distance traveled, and reimbursement rate.

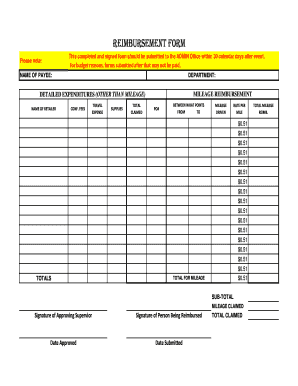

Advanced Mileage Reimbursement Spreadsheet: In addition to the basic fields, this type may include additional features like automatic calculations, multiple vehicle tracking, and expense category customization.

Online Mileage Reimbursement Spreadsheet: This type is web-based and allows users to access and update their mileage records from anywhere with an internet connection. It often offers cloud storage options and collaboration features for teams.

Mobile App Mileage Reimbursement Spreadsheet: This type is designed for smartphone or tablet use and provides a convenient way to track and manage mileage expenses on the go. It may have features like GPS tracking and integration with other expense tracking apps.

How to complete Mileage Reimbursement Spreadsheet

Completing a Mileage Reimbursement Spreadsheet is a straightforward process. Here are the steps to follow:

01

Open the spreadsheet: Start by opening the Mileage Reimbursement Spreadsheet in your preferred software program or online tool.

02

Enter starting and ending points: Add the starting point and destination for each trip in the corresponding fields.

03

Record distance traveled: Input the total distance traveled for each trip in miles or kilometers, based on your preference.

04

Calculate reimbursement amount: If the spreadsheet doesn't have automatic calculation features, multiply the distance traveled by the reimbursement rate to get the total reimbursement amount.

05

Review and verify data: Double-check the entered data for accuracy and ensure all necessary information is included.

06

Save and share: Save the completed Mileage Reimbursement Spreadsheet and share it as required with the relevant parties for reimbursement processing.

pdfFiller is a powerful online platform that empowers users to create, edit, and share documents effortlessly. With an extensive collection of unlimited fillable templates and powerful editing tools, pdfFiller offers a seamless PDF editing experience. Whether you need to work on a Mileage Reimbursement Spreadsheet or any other document, pdfFiller is the go-to PDF editor to get your tasks done efficiently.